State of Hawaii’s Credit Rating Strong

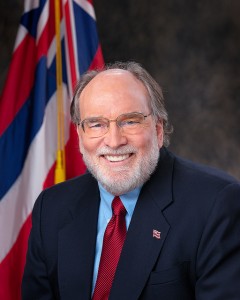

The State of Hawaii’s “AA/AA/Aa2” credit rating was reaffirmed by three major credit agencies, according an announcement by Governor Abercrombie.

Abercrombie encouraged Hawaii investors to take advantage of this strong rating and purchase tax-exempt state bonds on Nov. 13 and 14.

“By purchasing state bonds, Hawaii residents can invest in our state’s future and put their money to work building public facilities, improving our highways and repairing our children’s schools,” said Governor Abercrombie, in a written statement.

Three major credit rating agencies have each reaffirmed their rating of Hawaii for the state’s upcoming transaction to sell approximately $800 million in General Obligation bonds.

Fitch Ratings and Standard & Poor’s Rating Service reaffirmed their “AA” rating, while Moody’s Investors Service reaffirmed its “Aa2” rating of the state.

They also attached “stable” outlooks on their ratings, indicating positive expectations on future economic and financial trends for Hawaii.

As part of the review process, each agency visited Hawaii in October to meet with state finance officials and the governor.

The agencies also noted a number of positive indications of Hawaii’s improving economy and attributes of strong financial management and structure.

In issuing their reports, each rating agency also noted several issues of financial and economic concern for the state, such as large pension and poorly-funded retiree health benefit liabilities, low reserve balances, and potential impacts of the federal budget issues.

“We have been working very closely with the state Legislature on specific legislation and strategies that will more directly address a number of the issues the credit agencies identified as concerns,” said Kalbert Young, the state’s Director of Finance.

“These efforts will continue to show investors that Hawaii is a good credit.”

The upcoming transaction to sell approximately $800 million in General Obligation bonds will consist of approximately $400 million in new money bonds to fund capital construction projects approved as part of the current biennium budget.

The state will also refund approximately $400 million in previously-issued and outstanding bonds for savings via expected lower interest rates.

This week, investors interested in purchasing any bonds should contact their financial advisors and/or brokers before November 13. Interest on bonds is paid twice a year. Bonds offered through this transaction will include taxable bonds and bonds exempt from state and federal income tax. Bonds may only be purchased through a registered broker and offered through an official statement.

Those interested in the bond sale can also call the Department of Budget and Finance at (808) 586-1518.