Bidding War for Maui Bonds Lands Low Interest Rate

By Wendy Osher

Maui County offered to sell its General Obligation Bonds via competitive sale for the first time in more than a decade, triggering a bidding war among more than a dozen Wall Street firms earlier this month.

In the end, county officials say Citi Group Global Markets won the bid for $70.2 million at 2.18% interest. Maui Communications Director Rod Antone issued information saying this was the lowest interest rate ever offered to Maui County.

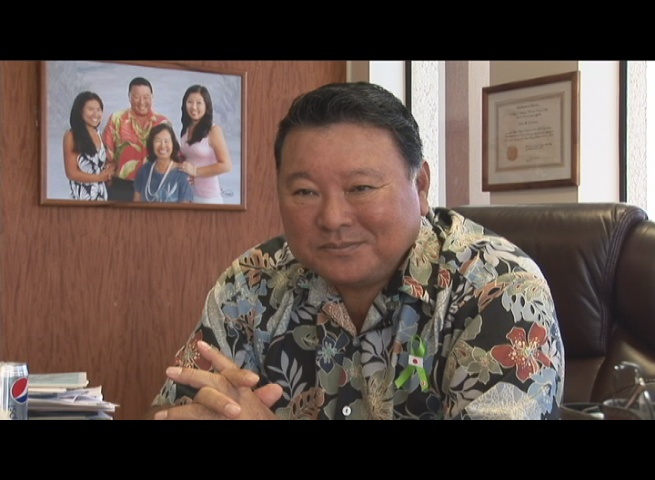

Maui Mayor Alan Arakawa said the competitive bid proves that Maui is a good investment. “These firms looked at Maui County’s financial stability and economic strength and they liked what they saw,” said Mayor Arakawa.

The money will be used to fund approximately $46 million in new county projects. The remaining $30 million will be used to help pay off the county’s debt, including prior bonds and state loans, according to county officials.

Last month, Moody’s, Standard & Poors, and Fitch rated Maui County’s bonds just below a Triple A rating, Aa1/AA+/AA+, the highest ratings in the state. Underwriters noted a strong tourism industry, booming construction projects and “strong financial operations” and “prudent fiscal management” as factors in their high ratings of Maui County.