Aloha State Makes Least Tax-Friendly List

The State of Hawai‘i has ranked fourth in Kiplinger’s list of the country’s least tax-friendly states, topped only by California, Connecticut and New Jersey.

Hawai‘i is also included in the list of 13 states that tax groceries, the list of five states with the highest gas taxes, and the list of the 10 states with the highest beer taxes.

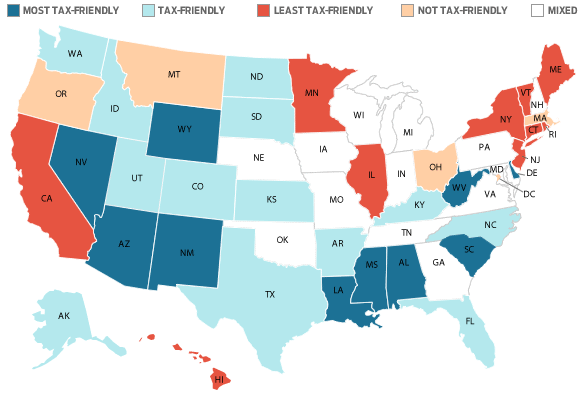

Kiplinger, a personal finance news and business forecaster, recently announced its rankings of the most tax-friendly states and least tax-friendly states as part of Kiplinger.com’s newly launched 2015 Tax Map, which compares taxes across all 50 states. The third annual Tax Map compares income tax, sales tax, gas tax, “sin” tax (for products such as alcohol and tobacco) and other tax types, rules and exemptions across all 50 states, offering an easy-to-use visual guide that features comprehensive tax profiles of each state, as well as additional roundups including states with no income tax, states with the highest gas taxes and states with the lowest beer taxes.

Go online to view Hawai‘i’s complete tax profile. Go online for the State-by-State Guide to Taxes.

“Over the next year, millions of Americans will move to a different state—for all sorts of reasons,” said Robert Long, managing editor of Kiplinger.com. “From young professionals moving across the country for a new job to working parents moving a state over to find a better home for their family, the Tax Map provides a valuable tool to people of all ages, backgrounds and career stages.”

Kiplinger’s 10 Most Tax-Friendly States:

- Delaware

- Wyoming

- Alaska

- Louisiana

- Alabama

- Mississippi

- Arizona

- New Mexico

- Nevada

- South Carolina

Kiplinger’s 10 Least Tax-Friendly States:

- California

- Connecticut

- New Jersey

- Hawai‘i

- New York

- Rhode Island

- Vermont

- Maine

- Minnesota

- Illinois

Kiplinger’s Tax Map is a sister project to Kiplinger’s annual Retiree Tax Map, which presents each state’s income taxes on investment income, retirement-plan withdrawals and Social Security benefits, plus a rundown of sales taxes, property taxes and estate and inheritance taxes.

“Many of the states that rank among the most tax-friendly for retirees are also the most tax-friendly across the board,” said Sandra Block, senior associate editor at Kiplinger’s Personal Finance. “The Tax Map and Retiree Tax Map are strong complements to each other—helping people make informed, financially sound decisions when considering moving to a different state.”