Maui, Wailea Lead the State in Average Daily Hotel Rates

Hotels across Hawaiʻi earned more revenue per available room in October at $189 (+3.8%) compared to a year ago, according to the Hawaiʻi Hotel Performance Report released by the Hawaiʻi Tourism Authority.

The growth in RevPAR was driven by a higher average daily rate in October of $240 (+3.6%) by hotel properties statewide, as occupancies remained virtually unchanged from last year.

Hotels in Maui County recorded the highest RevPAR in October at $221 (+7.0%), driven by a strong increase in ADR to $295 (+6.4%) year-over-year. Maui also led the state for the first 10 months of 2017 with an ADR at $344, an increase of 7.6%. Properties in the luxury resort area of Wailea led the state in both ADR at $520 (+9.2%) and occupancy at 85% (+4.0 percentage points).

Hotels on the island of Hawaiʻi earned the largest gain in RevPAR to $167 (+13%) in October, boosted by increases in ADR to $229 (+5.6%) and occupancies to 72.9% (+4.7 percentage points).

Kauaʻi hotels achieved the highest rate of growth in occupancy in October, up six percentage points in October year-over-year, completing the month at 77.1% occupancy.

Oʻahu hotels showed a slight decline in RevPAR in October at $182 (-0.5%) with an increase in ADR to $223 (+2%) offset by lower occupancy at 81.8% (-2.0 percentage points).

Wailea Leads the State in Luxury Hotel Growth

Luxury Class hotels achieved the best overall results on a statewide level in October of all hotel classes covered in the report compared to a year ago.

Luxury Class hotels reported increases in RevPAR to $323 (+5.7%), ADR to $438 (+4.3%), and occupancy to 73.6%(+1.0 percentage points).

Wailea lead the state in growth of RevPAR to $350 (+17.3%) and ADR to $448 (+15.7%), with occupancy recording a small increase to 78.2% (+1.1 percentage points).

The Lahaina-Kāʻanapali-Kapalua resort area reported growth in RevPAR to $194 (+3.4%) and ADR to $252 (+2.1%) in October, with occupancy increasing slightly to 76.9% (+0.9 percentage points).

The Kohala Coast resort area reported strong growth in RevPAR to $214 (+13.9%) and ADR to $307 (+11.1%), with occupancy also increasing to 69.6% (+1.7 percentage points) in October.

Midscale and Economy Class hotels also reached year-over-year growth in all three categories in October, with increases reported in RevPAR to $110 (+4.8%), ADR to $144 (+1.4%), and occupancy to 76.4% (+2.5 percentage points).

The other hotel classes covered by HTA’s Hawaiʻi Hotel Performance Report – Upper Upscale Class, Upscale Class, and Upper Midscale Class – all reported growth in ADR compared to last October.

“October was a solid month in what has been a good year overall for hotel properties statewide that reflects the tourism industry’s ability to attract travelers at different price points, particularly visitors seeking high-end accommodations,” said Jennifer Chun of HTA. “This is especially true for neighbor island hotel properties, which are largely realizing excellent year-over-year growth in revenues generated on a per room basis.”

Chun was recently appointed as Director of Tourism Research for HTA, a position that takes effect on December 1. She has analyzed tourism data for more than 20 years and worked in HTA’s Tourism Research Division since 2014.

Other Island Highlights:

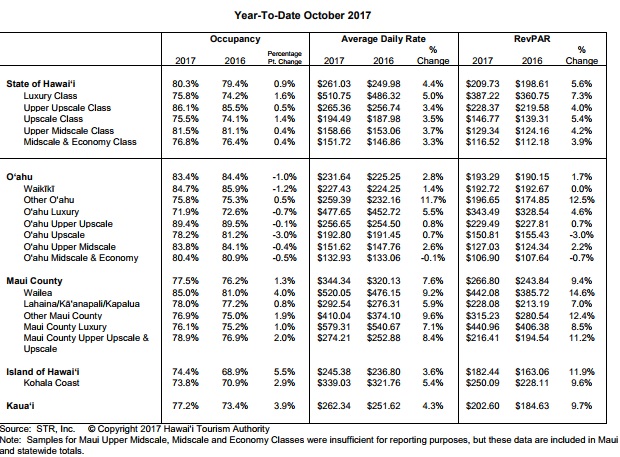

Oʻahu: Year-to-date through October, Oʻahu hotels reported the highest occupancy among the four island counties at 83.4% (-1.0 percentage points). Hotels reported an average increase in RevPAR to $193 (+1.7%) and ADR to $232 (+2.8%) through the first 10 months of 2017. On a monthly basis thus far in 2017, hotels have generally reported higher ADRs in 2017, while occupancies remained similar, compared to 2016. Hotels in Waikiki reported an ADR of $277 (+1.4%) and occupancy of 84.7% (-1.2 percentage points) year-to-date through October.

Island of Hawaiʻi: Year-to-date through October, hotels on the island of Hawaiʻi reported the largest average growth in occupancy statewide, increasing 5.5 percentage points to 74.4% occupancy. The growth was in line with increased visitor volumes reported through September, due largely to the new nonstop flights from Japan and the US mainland added within the past year. However, despite this growth, average hotel occupancy was the lowest of the four island counties. On a monthly basis, hotels achieved significantly higher occupancies through October than in 2016. During this period, hotels collectively increased ADR to $245 (+3.6%). ADRs were also higher each month in 2017, year-over-year, with the exception of September.

Kauaʻi: Through the first 10 months of 2017, hotels on Kauaʻi had a higher ADR at $262 (+4.3%) and experienced higher occupancy at 77.2% (+3.9 percentage points) compared to the same period in 2016. Hotels achieved a higher ADR in each month of 2017 and, except for July, recorded higher occupancy year-over-year compared to 2016.

Year-to-Date 2017

Year-to-date through October 2017, Hawaiʻi hotels collectively reported increases in RevPAR to $210 (+5.6%) and ADR to $261 (+4.4%), with occupancy at 80.3% (+0.9 percentage points) compared to the same period in 2016.

For the first 10 months of 2017, Luxury Class hotels reported overall increases in RevPAR to $387 (+7.3%) and ADR to $511 (+5.0%), with occupancy at 75.8% (+1.6 percentage points).

On the other end of the price spectrum, Midscale and Economy Class hotels earned increases in RevPAR to $117 (+3.9%) and ADR to $152 (+3.3%), but no growth in occupancy (76.8%) year-over-year.

On a monthly basis in 2017, hotels statewide generally outperformed 2016 numbers highlighted by a strong summer travel season with July producing peak ADR totals at $282 (+3.4%) and occupancy at 84.5% (+2.0%).

In September, despite increased visitor volumes, hotels statewide averaged a lower ADR (-1.7%) and flat occupancy compared to September 2016. There was also a 38% drop in meetings, conventions and incentive visitors, a market that typically has a strong preference for hotels. A significant factor for this decrease was the Hawaiʻi Convention Center’s hosting of the IUCN World Conservation Congress (10,000 delegates) and an insurance underwriter convention (11,000 delegates) in September 2016.