HTA: Hawaiʻi Hotel Performance Report for March 2021

In March 2021, Hawaiʻi hotels statewide reported similar revenue per available room, average daily rate and occupancy compared to March 2020. This was the first time in a year where those performance indicators were not substantially down; however, results differed by county–that according to the latest Hotel Performance Report compiled by the Hawaiʻi Tourism Authority’s Research Division.

Year-to-date, the statistics for statewide hotel RevPAR, ADR and occupancy were much lower compared to the first three months of 2020 as Hawaiʻi’s quarantine order for travelers due to the COVID-19 pandemic began on March 26, 2020, which immediately resulted in dramatic declines for the hotel industry, according to the HTA.

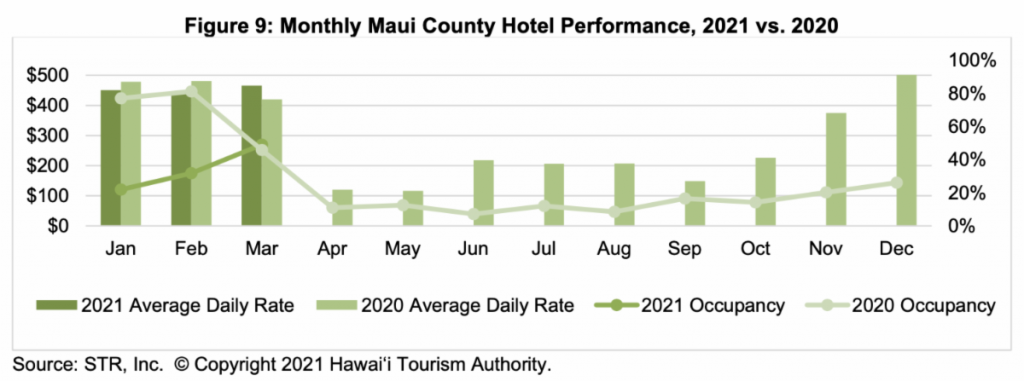

Maui County hotels reported better performance compared to last year and led the counties in March RevPAR of $228 (+18.7%), with ADR rising to $466 (+10.9%) and occupancy of 49 percent (+3.2 percentage points). Maui County’s March supply was 392,800 room nights (-0.3%). Maui’s luxury resort region of Wailea had RevPAR of $362 (+26.0%), with ADR at $802 (+27.2%) and occupancy of 45.2 percent (-0.5 percentage points). The Lahaina/Kāʻanapali/Kapalua region had RevPAR of $180 (+7.1%), ADR at $379 (+3.2%) and occupancy of 47.4 percent (+1.7 percentage points).

According to the Hawaiʻi Hotel Performance Report, statewide RevPAR in March 2021 was nearly the same as last year at $123 (-0.3%), ADR was slightly higher at $285 (+1.4%) and occupancy was 43.1 percent (-0.7 percentage points).

The report’s findings utilized data compiled by STR, Inc., which conducts the largest and most comprehensive survey of hotel properties in the Hawaiian Islands. For March, the survey included 150 properties1 representing 43,889 rooms, or 82.6 percent of all lodging properties and 86.9 percent of operating lodging properties with 20 rooms or more in the Hawaiian Islands, including full service, limited service and condominium hotels. Vacation rental and timeshare properties were not included in this survey.

During March 2021, most passengers arriving from out-of-state and traveling inter-county could bypass the state’s mandatory 10-day self-quarantine with a valid negative COVID-19 NAAT test result from a Trusted Testing Partner through the state’s Safe Travels program. All trans-Pacific travelers participating in the pre-travel testing program were required to have a negative test result before their departure to Hawaiʻi. Kauaʻi County continued to temporarily suspend its participation in the state’s Safe Travels program, making it mandatory for all trans-Pacific travelers to Kauaʻi to quarantine upon arrival except for those participating in a pre- and post-travel testing program at a “resort bubble” property as a way to shorten their time in quarantine. The counties of Hawaiʻi, Maui and Kalawao (Molokaʻi) also had a partial quarantine in place in March.

*Further details released in the report include the following:

Hawaiʻi hotel room revenues statewide declined to $192.4 million (-7.1%) in March. Room demand was 675,700 room nights (-8.4%) and room supply was 1.6 million room nights (-6.8%). Many properties closed or reduced operations starting in April 2020. If occupancy for March 2021 was calculated based on the pre-pandemic room supply from March 2019, occupancy would be 14.1 percent for the month.

In March 2021, the top and bottom price classes showed growth compared to March 2020. Luxury Class properties earned RevPAR of $297 (+36.4%), with higher ADR at $776 (+33.6%) and occupancy of 38.2 percent (+0.8 percentage points). Midscale & Economy Class properties earned RevPAR of $93 (+2.8%) with ADR at $193 (+7.5%) and occupancy of 48.2 percent (-2.2 percentage points).

Hotels on the island of Hawaiʻi also reported RevPAR growth to $157 (+26.7%), with ADR at $317 (+17.6%) and occupancy of 49.6 percent (+3.5 percentage points). The island of Hawaiʻi’s March supply was 202,600 room nights (-2.2%). Kohala Coast hotels earned RevPAR of $262 (+46.2%), with ADR at $476 (+16.0%) and occupancy of 55.1 percent (+11.4 percentage points).

Oʻahu hotels continued to lag with RevPAR of $74 (-20.1%) in March, ADR at $184 (-16.1%) and occupancy of 40.4 percent (-2.0 percentage points). Oʻahu’s March supply was 870,100 room nights (-8.3%). Waikiki hotels earned $68 (-23.2%) in RevPAR with ADR at $173 (-19.5%) and occupancy of 39.4 percent (-1.9 percentage points).

Kauaʻi hotels earned RevPAR of $62 (-53.3%), with ADR at $200 (-31.7%) and occupancy of 30.9 percent (-14.3 percentage points). Kauaʻi’s March supply was 100,600 room nights (-22.9%).

Tables of hotel performance statistics, including data presented in the report are available for viewing online.