TAT Bill Gains Senate Backing, Governor Weighs In

[flashvideo file=http://www.youtube.com/watch?v=_i2SXngUer8 /] By Wendy Osher

The Hawaiʻi State Senate advanced a list of more than 170 bills ahead of the legislative second crossover deadline, including a measure that would remove the cap on the transient accommodations tax revenues to be distributed to the counties.

Maui Mayor Alan Arakawa and Council leaders on Maui have been advocating for a restoration in the TAT revenues, with the council passing a resolution last week urging support of House Bill 1671.

According to council members, House Bill 1671 would return 44.8% of TAT revenues to the counties, which translates to approximately $165 million in annual TAT revenue to the counties.

The measure proposes to remove the current cap on the counties’ share of the TAT, which is a tax that is collected when a guest stays in a hotel or other accommodation in the state for less than 180 days.

During a recent interview with Mayor Arakawa, he said the county budget hinges on whether or not the state is going to remove the Transient Accommodations Tax.

The TAT cap was established in 2011 as a temporary measure to assist the state government in its recovery from the economic downturn. Now, three years later, county officials say it’s time to restore those funds.

“If they don’t remove the cap, then we’re going to have to ask the community for a property tax increase of 6.7%. If they remove the cap, we can actually ask the council to not raise any of the property taxes and actually possibly reduce some,” Mayor Arakawa said during the interview.

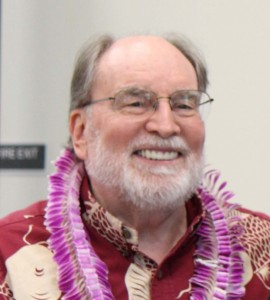

Governor Neil Abercrombie has also been monitoring the progress of the bill and weighed in from the state administration’s perspective saying in an exclusive interview on Friday, “I make it a point to try and not make to not make predictions about what the legislature will do; but the question of the division of the revenue coming from travel and tourism taxes is something that’s a perennial discussion in the legislature, so we’ll see how that works out.”

He said the object is to increase the amount of money coming to the counties, and to the same degree, the state has to make enough revenues another way.

“For residents and taxpayers throughout the state, no matter what county you’re in, the state responsibilities and county responsibilities all have to be met, and all have to be paid for. So, be careful what you wish for,” he said.

“You may find an advantage on one hand, and a disadvantage on the other; but for purposes of meeting community needs, service needs, the division of the revenues from travel and tourism really should be discussed,” said Abercrombie.

“Now whether it ends up at the county or the state level is problematic, and political considerations naturally come into the picture; but the fact that the county provides services and the state provides services is an ongoing reality of hospitality and tourism, so how that works itself out I wait for the end of the legislative session to see what conclusions were reached,” he said.

Other bills advanced by the senate include measures aimed at kūpuna support, environmental protection, community investment, fiscal responsibility, education, homelessness, public safety and tourism.

A list of bills highlighted by Senate leaders include the following:

Education

- HB2109 HD2 SD1: establishes a five-year evidence-based physical-activity and nutritional-education pilot program within the A+ Program in Hawaii’s public elementary schools.

- HB1777 HD2 SD2: authorizes DOE employees and agents with specified training to volunteer to administer auto-injectable epinephrine to a student with anaphylaxis. Allows DOE to make arrangements to receive auto-injectable epinephrine supplies from manufacturers and suppliers.

- HB2598 HD1 SD2: renames the Hawaiʻi 3R’s School Repair and Maintenance Fund the Hawaiʻi 3R’s School Improvement Fund. Requires the transfer of moneys collected pursuant to section 235-102.5(b), Hawaiʻi Revised Statutes, and authorizes the transfer of any other moneys received in the form of grants and donations for school-level improvements and minor repairs and maintenance to the Hawaiʻi 3R’s School Improvement Fund.

- HB1676 HD1 SD1: appropriates funds to, and authorize, the Executive Office on Early Learning to enter into agreements with the Department of Education and public charter schools to use available classrooms for public preschool.

- HB1756 HD1 SD2: statutorily establishes the Resources for Enrichment, Athletics, Culture, and Health program within the Office of Youth Services to provide after-school programs in public middle and intermediate schools. Establishes a special fund.

Environmental Protection

- HB2434 HD1 SD1: increases financial resources to support a conservation and natural resource protection program in the State. Specifies the distribution and allowable uses, subject to agreement between the HTA and the BLNR, of transient accommodations tax revenues allocated to the special land and development fund for resource and facilities management costs related to the HTA’s strategic plan.

- HB2620 HD1 SD2: requires the University of Hawaiʻi Sea Grant College Program to submit a report updating the 1996 report on oil spills.

- HB1514 HD1 SD2: appropriates moneys for mitigation of, and education relating to, the coffee berry borer.

Transient Accommodations Tax

- HB1671 HD1 SD1: removes the current cap on transient accommodations tax revenues to be distributed to the counties and establishes the distribution of these revenues as a percentage of TAT collected.

Community Investment

- HB2217 HD2 SD1: (Workforce Development) authorizes DLIR to establish working groups to identify high growth industries and workforce needs and to develop training programs.

- HB2007 HD1 SD2: (Agriculture) appropriates funds to the Local and Immigrant Farmer Education Program of the University of Hawaiʻi College of Tropical Agriculture and Human Resources Cooperative Extension Service to support the growth and sustainability of the agriculture industry.

- HB2468 SD2: (Agriculture) authorizes DBEDT, in collaboration with DOA, to perform studies and analysis relating to: (1) Establishing facilities on the island of Hawaii for quarantine inspection and treatment and handling imported and exported commodities; and (2) Implementation of designated foreign-trade zone sites. Creates an agricultural technology park under the HTDC.

- HB2169 HD1: (Tourism) provides an incentive for the private sector to invest in hotel and resort construction and renovation.

- HB2371 HD1 SD1: (Tax relief) reduces the tax burden on the lowest income residents of the State by amending the amount and threshold of the refundable food/excise tax credit and income tax credit for low-income household renters, and creates a new low-income tax credit and earned income tax credit.

- HB1934 HD1 SD2: (Homelessness) appropriates funds to various programs that provided housing, housing assistance, and supportive services to individuals at risk of or experiencing homelessness.

Other Notable Legislation

- HB1667 HD3 SD2: (Veterans) provides qualifying totally and permanently disabled veterans an exemption of one-half of the state vehicle registration fee, rounded up to the nearest dollar. Requires the Office of Veterans’ Services to report the number of qualifying veterans to the Legislature and Department of Taxation.

- HB1926 HD1 SD1: (Crime) amends the offense of prostitution to clarify that a law enforcement officer shall not be exempt from the offense if the law enforcement officer engages in sexual penetration while acting in the course and scope of duties; and establish that a person less than eighteen years of age shall not be prosecuted for prostitution or promoting prostitution offenses if the person is charged with a first and only prostitution charge; provided that a person’s exemption shall not affect the prosecution of any other person for a prostitution or promoting prostitution offense. Amends the offense of solicitation of a minor for prostitution. Clarifies sentencing of repeat offenders and enhanced sentences for repeat violent and sexual offenders.

Members of the Senate and House will convene conference committees next week to work out any differences in the measures.