Watch the Video

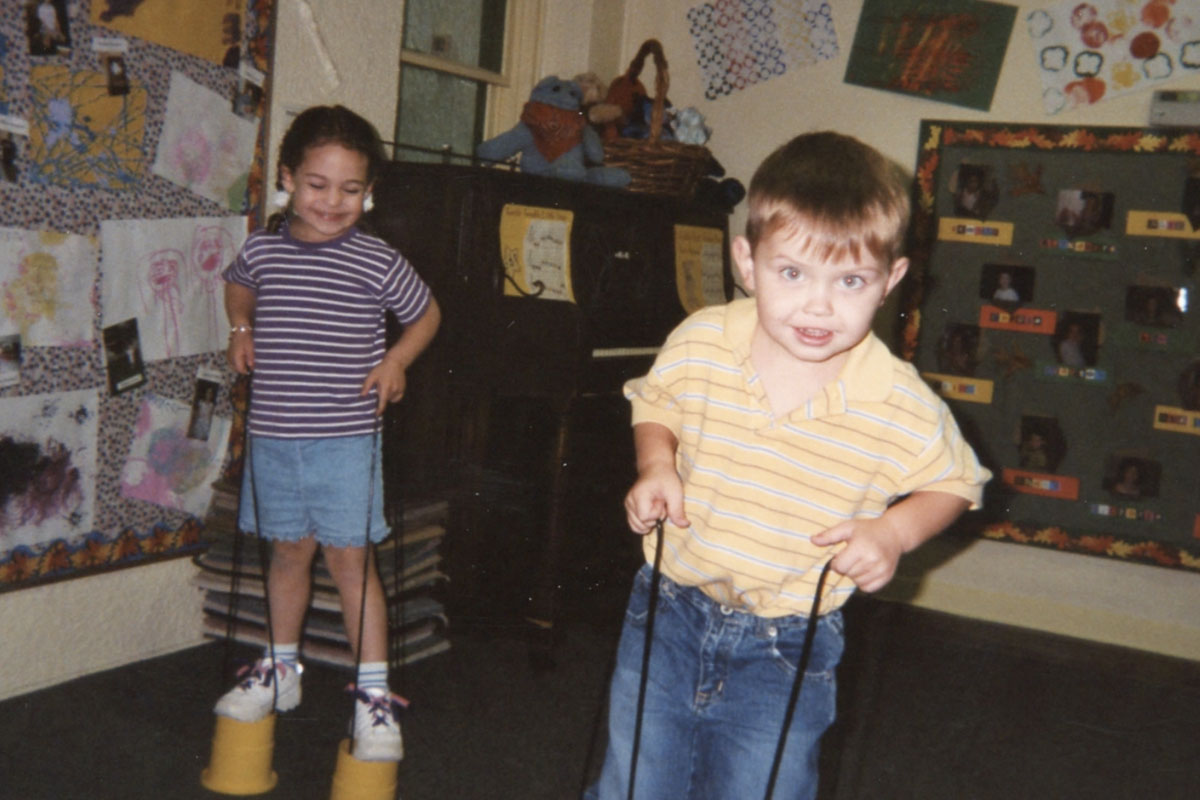

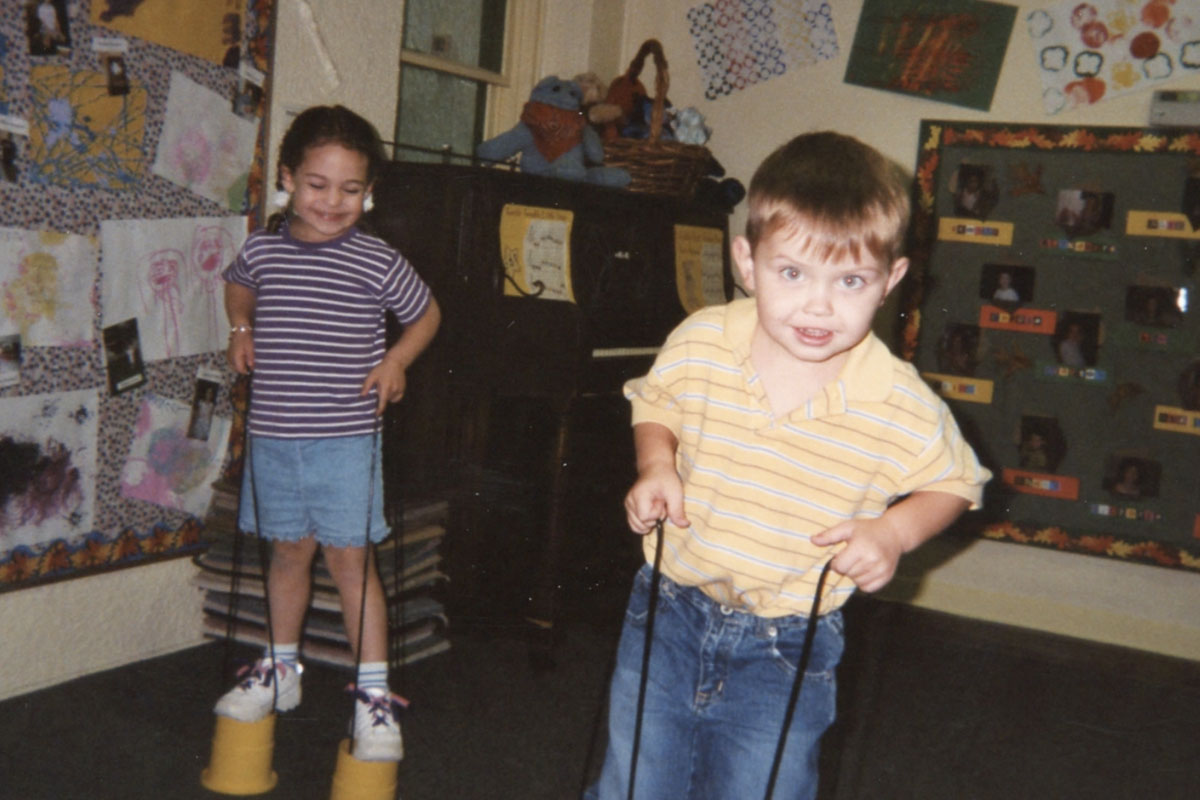

Watch the VideoImua’s dream for the Discovery Garden is to inspire children while they learn and grow and to equip parents and teachers with a safe naturalistic environment where learners of all abilities can develop at their own pace.

Virtual Tour

Virtual TourOur “Nature Play Spaces” encompass Imua Inclusion Preschool and outdoor classroom, an open-air children’s amphitheater, family picnic spaces, and gardens where kids can connect, play, and learn outdoors. Mud tables, interactive walls, activity panels, and sensory gardens will be designed so children with disabilities can play alongside their able-bodied friends and siblings. These unique grounds will promote acceptance and compassion – both important values for children to embrace.

View the ConceptOutdoor classroom time in nature provides meaningful, hands-on learning,meaningful, hands-on learning, and the skills children develop will help them be more successful in school and in navigating their world.

Located in the Wailuku Historic District, the former Yokouchi Estate was designed by Charles William Dickey, a prominent 20th century architect. “It is fitting that the legacy of this property would now become a place of discovery, to serve and touch the lives of children and families here for decades to come.” said Dean Wong, Imua Family Executive Director.

Access to the neighboring Maui Historical Society directly from Imua Discovery Garden will allow guests of either organization to benefit from a wide range of cultural and learning experiences. In addition to partnership with the Maui Historical Society, Imua Family Services will look to partner with groups and organizations on such priorities as sustainable planting, farm-to-child learning, environmental stewardship, non-violent communication, arts and culture, as well as health and well-being.

September 08, 2024Imua Family Services presents 3rd annual Butterfly Festival for families and kids on World Peace Day

September 08, 2024Imua Family Services presents 3rd annual Butterfly Festival for families and kids on World Peace Day April 28, 2024Huliau Youth Environmental Film Festival, May 4

April 28, 2024Huliau Youth Environmental Film Festival, May 4 April 09, 2024Capturing smiles, creating change: Imua Family Services launches SMILE Imua family portrait day fundraiser

April 09, 2024Capturing smiles, creating change: Imua Family Services launches SMILE Imua family portrait day fundraiser

Aloha from VIP Foodservice and Island Grocery Depot, founded by Roy H. and Lorraine M. Okumura, locally Grown and Family Owned serving Maui since 1951. Whether for home or business we are here for you Maui. We are committed to ensuring a sustainable island home. We choose vendors that make smart decisions for the planet. We buy local since local foods are important to the growth of our island home economy. We also believe it is imperative to give back to support and improve the well-being of our Maui home and community, so the Roy H. and Lorraine M. Okumura Foundation donates to those organizations which do so and are making a profound difference. Together with our support of Imua Family Services for Imua Discovery Garden, Imua will continue to move forward as a leader and premier provider of innovative programs focused on childhood development and family strengthening, dedicated to building healthier and happier families and a more connected community; thereby improving the quality of life for all.

Visit Website

Since its inception in February 2021, Aina Brands has been focused in responsible food manufacturing and marketing; from farming our own innovative produce, to promoting new food concepts through our restaurant brand; 1111 Nikkei. The company and its shareholders have committed to run the business in a socially responsible manner by actively being involved in the local Maui community. Aina Brands believes that the most important piece of the community is the livelihood of children and the support for children with special needs and their families, this is why Aina Brands has pledged 10% of all profits to support the efforts of Imua Family Services and Imua Discovery Gardens.

Visit Website

Aloha, I am Leslie Ann, and I am so excited for Better Homes and Gardens to be part of the building blocks of the new Imua Discovery Garden at the former Yokouchi Estate. I have been in real estate for over 35 years, and I come from a family of realtors. My father, a well-known realtor on Maui, got his start back in the 1960's. He taught me the importance of building a better community and giving back to the community. Building Imua Discovery Garden will help grow healthier, stronger and better-connected children, families and community. These are values we hold close at Better Homes and Gardens. We hope you will join us in helping Maui's keiki and support the growth and development of Imua Family Services and Imua Discovery Garden.

Visit Website

Mahi Pono is committed to Sustainability, we are committed to practicing sustainable agriculture, to growing food for local consumption, to responsible use of the natural resources entrusted to us, and to providing high quality agriculture employment for generations to come. Mahi Pono has been a delicious partner with Imua Family Services, helping to support our families and children with special needs. In October of 2020 during the pandemic together we organized a safe and fun Fall Harvest, proceeds from sales of Pumpkins, Produce, Cattle and Honey went to support Imua Family Services. Now in June of 2021 we are repeating the success of the Harvest with a Watermelon Harvest!

Visit Website

Imua Family Services’ mission is to "empower children and their families to reach their full potential." Our programs and staff assist children and their families overcome developmental learning challenges in their most critical formative years using play-based instruction designed to help them move forward.

Visit Website