What is the IRS’ Recovery Rebate Credit and who qualifies?

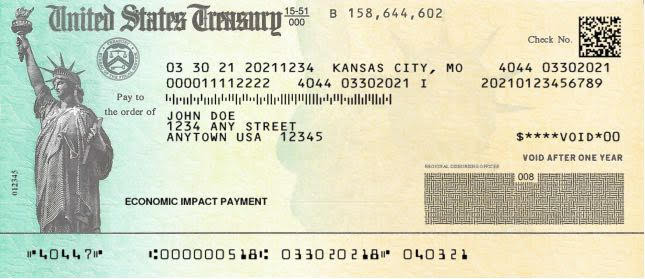

The Recovery Rebate Credit makes it possible for any eligible individual who did not receive all Economic Impact Payments (also known as stimulus payments) to claim the missing amount on their tax return.

Who might be eligible for this credit?

- Parents of a child born in 2021 – or parents and guardians who added a new child to their family in 2021 – may be eligible to receive up to $1,400 for the child.

- Families who added a dependent – such as a parent, a nephew or niece, or a grandchild – on their 2021 income tax return (and who were not listed as a dependent on their 2020 income tax return) may be eligible to receive up to $1,400 for this dependent.

- Single filers who had incomes above $80,000 in 2020 but less than this amount in 2021 may be eligible for up to $1,400 per person.

- Married couples who filed a joint return and had incomes above $160,000 in 2020 but less than this amount in 2021 may be eligible for up to $1,400 per person.

- Head of household filers who had incomes above $120,000 in 2020 but less than this amount in 2021 may be eligible for up to $1,400 per person.

- Single filers who had incomes between $75,000 and $80,000 in 2020 but had lower incomes in 2021 may be eligible.

- Married couples who filed a joint return and had incomes between $150,000 and $160,000 in 2020 but had lower incomes in 2021.

- Head of household filers who had incomes between $112,500 and $120,000 in 2020 but had lower incomes in 2021 may be eligible.

Most eligible people for the Economic Impact Payments won’t need to claim a credit on their tax return because they already have received the full amount of these payments. The stimulus checks stem from the American Rescue Plan Act, which was passed to help the country recover from the COVID-19 pandemic.

Third-round Economic Impact Payments were advance payments of the 2021 Recovery Rebate Credit.

Through Dec. 31, the IRS issued more than 175 million third-round payments totaling more than $400 billion to individuals and families across the country while simultaneously managing an extended filing season in 2021. No more third-round payments will be issued, although some may still be in the mail.

In late January, the IRS began issuing Letter 6475, Your Third Economic Impact Payment, to recipients of the third-round Economic Impact Payment. This letter will help Economic Impact Payment recipients determine if they are entitled to and should claim the Recovery Rebate Credit on their 2021 tax returns when they file in 2022.

Individuals must claim the 2021 Recovery Rebate Credit on their 2021 income tax return in order to get this money; the IRS will not automatically calculate the 2021 Recovery Rebate Credit. The IRS began accepting 2021 income tax returns on January 24.

The IRS issued additional payments – called “Plus-Up” Payments – to individuals who initially received a third-round Economic Impact Payment based on information on their 2019 tax return and were eligible for a larger amount based on information on their 2020 tax return.

Avoid processing delays when claiming the 2021 Recovery Rebate Credit

The IRS strongly encourages people to have all the information they need to file an accurate return to avoid processing delays. If the return includes errors or is incomplete, it may require further review while the IRS corrects the error, which may slow the tax refund.

To claim the 2021 Recovery Rebate Credit, individuals will need to know the total amount of their third-round Economic Impact Payment, including any Plus-Up Payments, they received. People can view the total amount of their third-round Economic Impact Payments through their individual online account.

For married individuals filing a joint return with their spouse, each spouse will need to log into their own online account or review their own letter 6475 for their portion of their couple’s total payment.

Anyone with income of $73,000 or less, including those who don’t have a tax return filing requirement, can file their federal tax return electronically for free through the IRS Free File program. The fastest and most secure way to get a tax refund is to file electronically and have it direct deposited – contactless and free – into the individual’s financial account.

IRS.gov/filing has details about IRS Free File, Free File Fillable Forms, free VITA or TCE tax preparation sites in communities or finding a trusted tax professional.

Claim 2020 Recovery Rebate Credit for missing first- or second-round Economic Impact Payments

All first- and second-round Economic Impact Payments have been issued. The first- and second-round Economic Impact Payments were an advance payment of tax year 2020 Recovery Rebate Credit. People who didn’t qualify for a first- and second- Economic Impact Payment or got less than the full amounts may be eligible to claim the 2020 Recovery Rebate Credit on a 2020 income tax return. Individuals will need to file a 2020 tax return if they have not filed yet or amend their 2020 income tax return if it’s already been processed.

If the individual’s 2020 income tax return has not yet been fully processed, the individual should not file a second return. Some returns need special handling to correct errors or credit amounts, which can delay processing. The IRS is having to correct significantly more errors on 2020 tax returns than in previous years. If the IRS corrects the credit claimed on the return, the IRS will send a letter with an explanation.

More information