Gov. Green extends family tax credit, signs biennium budget

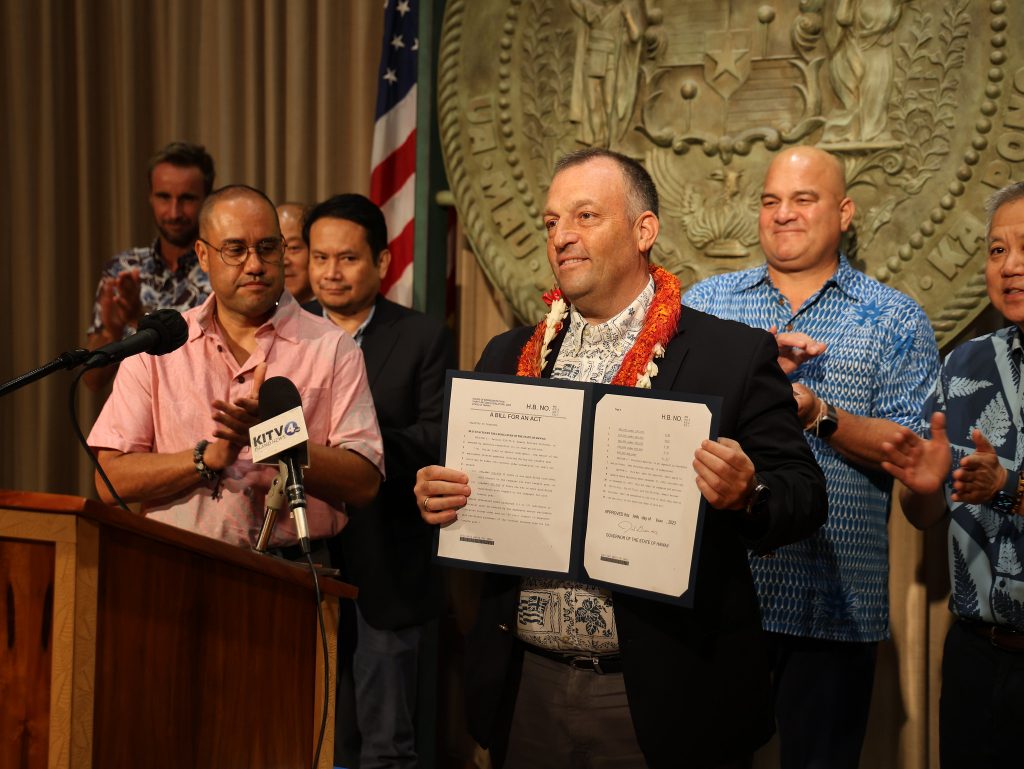

Governor Josh Green, M.D., on Friday signed legislation to provide “sweeping income support” to Hawaiʻi’s working families, and to fund state operations for the coming fiscal biennium.

HB954 (Act 163) gives $104 million of income support to local taxpayers, “many of whom will receive tax refunds worth thousands of dollars that will flow back into their household budgets to help make ends meet,” according to the governor’s announcement.

The bill doubles the size of the Earned Income Tax Credit for five years, providing $50 million in additional support. The bill also doubles the amount of the Food Excise Tax Credit, benefitting an additional 90,000 of the most economically vulnerable residents in the state, according to the governor. “Working families who struggle to pay for child or dependent care will receive a refundable credit of up to $3,000 to help ease the high costs of living they face every day,” according to state officials.

“The people of Hawaiʻi honored me with this position in the hope that my administration would make their lives better. It is a top priority of mine, and it is thanks to the collaboration between my Administration and legislative leaders that our families will receive this relief,” said Governor Green said in a news release.

“The budget and tax bills truly represent cooperation between the Administration, 76 legislators, and the general public,” said House Speaker Scott Saiki (District 25, Ala Moana Kakaʻako, Downtown). “They will deliver direct relief to over 200,000 families, our statewide parks and trails, our climate, and unsheltered individuals in need of mental health assistance.”

Senator Donovan Dela Cruz, chair of the Senate Ways and Means Committee, hailed the tax break bill as a positive financial benefit for struggling families.

“HB954 is a positive step towards addressing the financial challenges faced by the ALICE (Asset Limited, Income-Constrained, Employed) population in Hawaiʻi,” said Senator Dela Cruz (District 17, portion of Mililani, Mililani Mauka, portion of Waipi‘o Acres, Launani Valley, Wahiawā, Whitmore Village). “By increasing the tax credits for household and dependent care services, refundable income, and income threshold and credit amounts for refundable food and excise tax, HB954 aims to provide much-needed support to working families.”

Hawaiʻi Community Foundation CEO Micah Kāne said he believes the multi-faceted approach to relief for ALICE families will have a long-lasting impact.

“It was important for the Governor and the legislature to allocate resources for immediate relief for the families that addresses major cost-drivers, like early learning and affordable housing,” Kāne said. “You can’t really do one without the other; you have to do both. I think the Governor’s investment in affordable housing and continued commitment to early learning will reduce the ALICE numbers in the long run,” Kāne said.

Governor Green today also signed HB300 (Act 164), the state budget for the fiscal biennium.

The budget appropriates

- $10.7 billion in FY24 and $9.8 billion in FY25 for general funds;

- $19 billion in FY24 and $18.2 billion in FY25 for Executive Branch departments and agencies for the operating budget.

- The budget also appropriates $2.9 billion in FY24 and $1.3 billion in FY25 for capital improvement projects.

Governor Green on Thursday provided official notice to lawmakers, finalizing line-item reductions and vetoes.

“When we received the Council on Revenues’ lowered revenue projections, it was clear that we had to right-fit the budget to align with the priorities of our Administration and legislature ̶ housing, homelessness, health care services, education and the environment,” Governor Green said, noting that a balanced state budget is required by law.

“With the signing of HB300, the state budget bill, we can expect that the resources provided within it, coupled with the shared commitment of the legislature and the Governor, will allow for considerable progress to be made in addressing Hawaiʻi’s greatest challenges,” Senator Dela Cruz said. “Millions of dollars have been put forth to tackle homelessness, the housing crisis, mental health, and workforce shortages, to name a few.”

HB954 HD2 SD2 CD1, Relating to Taxation (Act 163): Increases the household and dependent care services tax credit for five years. Increases the refundable earned income tax credit for five years. Increases the income thresholds and credit amounts of the refundable food/excise tax credit for five years. (CD1)

HB300 HD1 SD1 CD1, Relating to the State Budget (Act 164): Appropriates funds for the operating and capital improvement budget of the Executive Branch for fiscal years 2023-2024 and 2024-2025. (CD1)