UHERO: Construction up following Lahaina wildfires, partial recovery of visitor and labor market on Maui

Hawaiʻi’s economy has been sustained by a resilient US economy and the gradual return of international visitors. According to the University of Hawaiʻi Economic Research Organization’s first quarter forecast for 2024, with the islands’ post-pandemic recovery now largely complete, the economy will downshift this year, and growth will increasingly come from local sources, including a robust construction sector bolstered by the rebuilding of Lahaina, Maui.

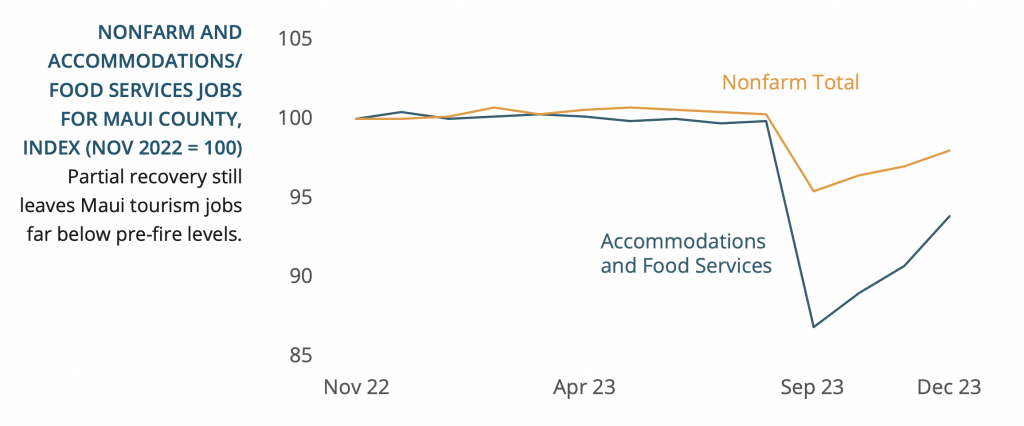

“On the Valley Isle, the initial visitor recovery after the wildfires has proven somewhat stronger than expected, but rebuilding will take a long time, with many uncertainties about how this will play out,” according to the forecast.

Key takeaways from the February 23 report:

- The US economy is off to a positive start in 2024, characterized by strong consumer spending, still-healthy job markets and substantial progress on inflation. This makes a “soft landing” now more likely than not. Challenges such as credit delinquencies and reduced savings will moderate consumer spending this year, while high interest rates continue to impact some sectors. Global economic challenges, including weakness abroad and the strong dollar, will keep US economic growth just below 2%.

- Hawaiʻi’s visitor industry showed resilience in 2023, with real visitor spending hovering near historic highs in the first quarter. There was some weakening of the industry even before the Maui wildfires, which of course dealt a heavy blow to the Valley Isle. US visitor arrivals eased a bit in the second half of 2023, partly offset by an uptick in Canadian and Japanese visitors, although the latter still lag by half their pre-pandemic level. Per person visitor spending has risen, but challenges remain, including the poor purchasing power of foreign currencies. Visitor arrivals will see modest growth of 2% this year, and real visitor spending will soften.

- The construction industry has been buoyed by large federal and state contracts, as well as robust home building on Oʻahu. To meet the needs of Maui rebuilding, the industry will expand further, adding 2,500 workers over the next three years.

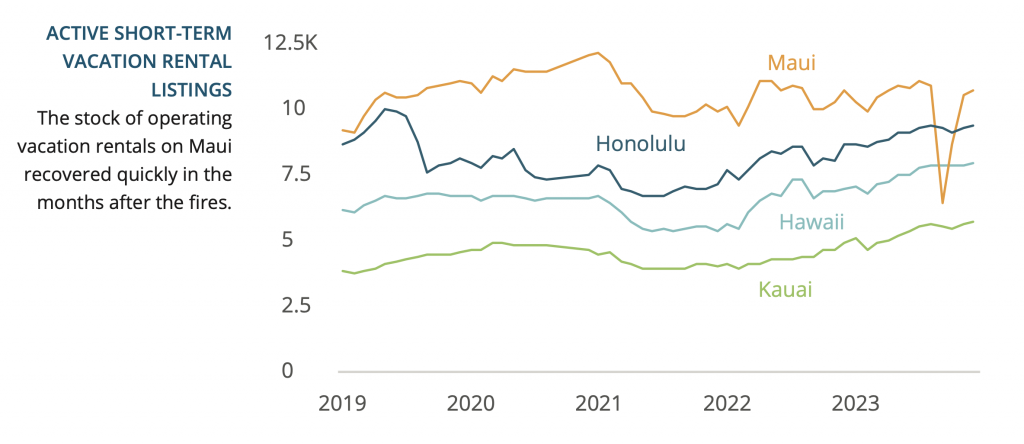

- The Maui Interim Housing Plan allocates $500 million to fund housing for families displaced by the wildfires, primarily through a leasing program targeting vacation rentals. Recovery efforts focus on debris removal and rebuilding permits, with grants offered for ʻohana unit construction to address the housing shortage. Nonetheless, recovery remains a long road ahead.

- High housing costs are a challenge throughout the islands. To address this, state and county governments are pushing to increase restrictions on short-t erm rentals, hoping to encourage owners to return these properties to long-term housing. While several proposals have been floated, the relatively small incentives may not have a substantial impact on the housing stock. Other initiatives that support the building of new homes are more promising.

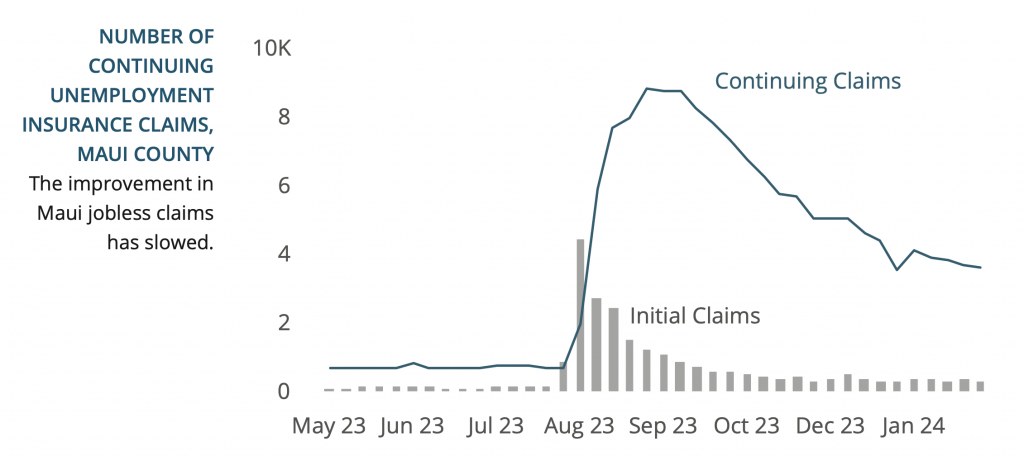

- While the labor market recovery on Maui was stronger than expected following the wildfires—supported by an already tight labor market—the pace of improvement in unemployment insurance claims has slowed. Unfortunately, workers who first filed for benefits in the weeks after the fire will begin losing eligibility this month.

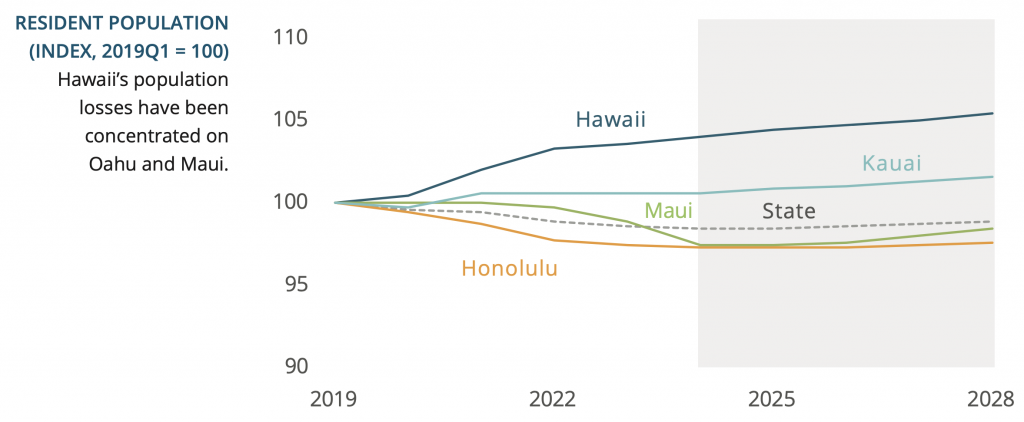

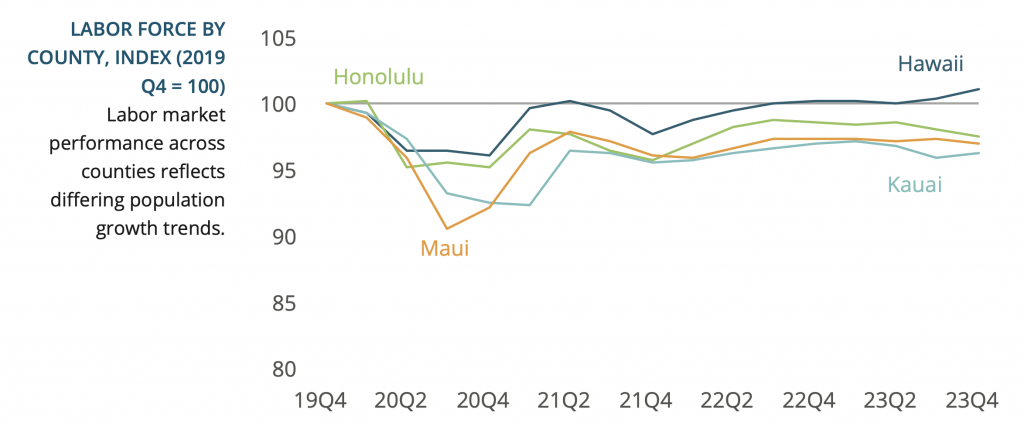

- Elsewhere in the state, labor markets remain healthy. Employment has held steady or increased slightly on Hawaiʻi Island, Oʻahu and Kauaʻi. There are differences in county labor market performance associated with different population trends. Net population growth on the Big Island has raised the labor force above pre-pandemic levels, while the other counties remain 3%–4% below their pre-COVID levels.

- The slowing of population and labor force growth is a long-term phenomenon and will cause job and income growth rates to trend lower than in the past. Over the next three years, payrolls will grow at a less than 1% average annual rate, while real income will expand at about 1.7% per year.

UHERO is housed in UH Mānoa’s College of Social Sciences.

Read the entire report HERE.