Hawai‘i Journalism Initiative

Hawai‘i Journalism InitiativeDisplaced Lahaina fire survivors eager to rebuild with help from $1.6 billion federal grant

LAHAINA — Kelcy Durbin and her family are in a time crunch for multiple reasons to rebuild the home they lost in the August 2023 wildfire in Lahaina.

Her brother’s family lives in a rental unit in Lahaina where their assistance program is set to end in August. Her niece and two daughters live in a rental in Kahului covered by the Federal Emergency Management Agency, whose direct lease program will expire in February. And, the family has to start construction by October in order to access a loan from the U.S. Small Business Administration.

HJI Weekly Newsletter

Get more stories like these delivered straight to your inbox. Sign up for the Hawai‘i Journalism Initiative's weekly newsletter:

The Durbins are among the many families eager to apply for the homeowner reconstruction program that Maui County is launching next month with funding from a $1.6 billion federal grant.

Earlier this year, the county received the recovery grant, which aims to help people rebuild their homes or get reimbursed if they’ve already rebuilt.

“Construction costs are so high,” Durbin said. “Even when we started talking numbers to rebuild, our rebuild number between February and then in June is $150,000 more.”

Applications to rebuild have ramped up in the nearly two years since the fire. According to the Maui County recovery dashboard, 453 building permits had been issued in Lahaina and Kula, with another 323 being processed as of Tuesday. So far, 42 buildings, all residential, have been completed.

In June, Mayor Richard Bissen signed an agreement with the federal government to secure the $1.6 billion in Community Development Block Grant Disaster Recovery funds. Maui County was one of the first to sign a contract of the 47 grantees across 23 states who received a total of nearly $12 billion in program funds for 2023 and 2024 disasters.

John Smith, the administrator for the county’s Office of Recovery, said during a community meeting in Lahaina earlier this month: “It doesn’t feel like we’re moving fast, but … in federal government times, we’re moving at blazing speed.”

Over half of the grant — $903.6 million — will go towards housing initiatives, according to the county’s action plan for the funding. The rest includes $400 million for infrastructure needs, $213.8 million for disaster mitigation, $25 million for public services, $15 million for economic revitalization and nearly $82 million for costs of administrating the grant.

The three housing initiatives the county plans to launch next month include a first-time homebuyers program, a single-family homeowner reconstruction program, and a single-family homeowner reimbursement program, collectively described as the Ho‘okumu Hou Housing Programs. All are open to Lahaina and Kula residents affected by the fires.

The reconstruction program, which has $298.6 million set aside, is geared toward owners whose primary homes were destroyed by the wildfires and who have either not started or not finished rebuilding.

They must still own the property and earn at or below 140% of the area median income to be eligible. The maximum amount a home can receive is $1.2 million. And, individuals won’t get the funds directly but will have their home built for them.

The reimbursement program, which will draw from the reconstruction funding pot, provides up to $400,000 to homeowners who lost their primary home in the wildfires and have already rebuilt. Applicants must still own the property and earn at or below 140% of the area median income.

The first-time homebuyer program offers up to $600,000 for residents who were impacted by the wildfires, do not own a home and earn at or below 120% of the area median income. The program has an allocation of $185 million, with half for new home construction and half for first-time home purchases.

Other programs to be launched later include the reconstruction of multifamily rental housing ($235 million) and the building of new multifamily rental housing ($185 million).

Maui County will hold meetings on the first thee programs this week and is encouraging people to get their documents in order, including proof of identity for all adult household members, proof of property ownership and residency, income information, and insurance and disaster assistance records.

The Office of Recovery told the Hawai‘i Journalism Initiative via email that the county has brought on a vendor to help train case managers who will work with survivors through the application process.

Of the 1,355 homes that burned, 813 were owner-occupied. The county’s action plan doesn’t say how many units it plans to rebuild with the funds, but the total will likely depend on how much each homeowner gets. If every owner-occupied home were to get the maximum $1.2 million, that would mean about about 248 homes would get assistance. If each home received $500,000, that would mean about 597 homes would get assistance.

And, if all 42 already built homes sought the maximum reimbursement of $400,000, that would total $16.8 million.

Priority for funding will be given to people based on household income level, starting from 50% of the area median income, then 80% and so on, as well as households with children under age 18 or members over 62 with a disability.

If applicants have received funding aid from other programs, the office said it would take a look at the duplication of benefits during the application process to “help determine the amount an eligible applicant would be awarded.”

Even if they got funding from other sources, residents are encouraged to apply “so that the program can assess eligibility.”

HOPING TO RETURN HOME

Wahikuli resident Lori Apo is preparing to apply. The fire destroyed the 1,200-square-foot, two-story home that she inherited from her grandparents as well as her beloved 1994 Toyota, the first car she bought.

She had lived in the home since 1990, along with her mother, who passed away in 2017. They used to take sunset walks on the quiet cane haul road mauka of their neighborhood. Now that area is a busy development of temporary homes built by the state for fire survivors.

The 67-year-old retiree, who worked in a Lahaina dental office for three decades and grew to know many of the town’s families, said she’s tired of having to pay rent. The Kā‘anapali Shores condo where she now lives charges $3,000 a month, and the Kahana Sunset unit where she lived before charged $7,000, which she paid with the help of insurance and the Council for Native Hawaiian Advancement.

“It’s just not easy,” she said. “You either have to have nothing and you get everyone helping you, or you have plenty of money and you don’t have to worry. … Most people I know aren’t in those two categories.”

Like many residents, she was underinsured, and while she declined to say how much her payout was, she estimated it would only cover about a third of the cost to rebuild her home. She’s currently waiting on her building plans, which are being prepared pro bono by Kasprzycki Designs.

Apo wants to get back to Lahaina so badly, she’d rather pitch a tent on her burned-down lot than renew her lease when it expires in December. Two of her neighbors are already planning to sell, and she’s determined not to be next. Every other day, she comes to her property to water her plants, coaxing life out of a thriving noni tree, tiny pīkake plants and bunches of kabocha leaves. She jokes that since moving from 4909 to 3445 Lower Honoapi‘ilani Road, she’s 1,500 blocks closer to home.

“I’m going to live here till I die,” she said. “Lahaina is the place for me.”

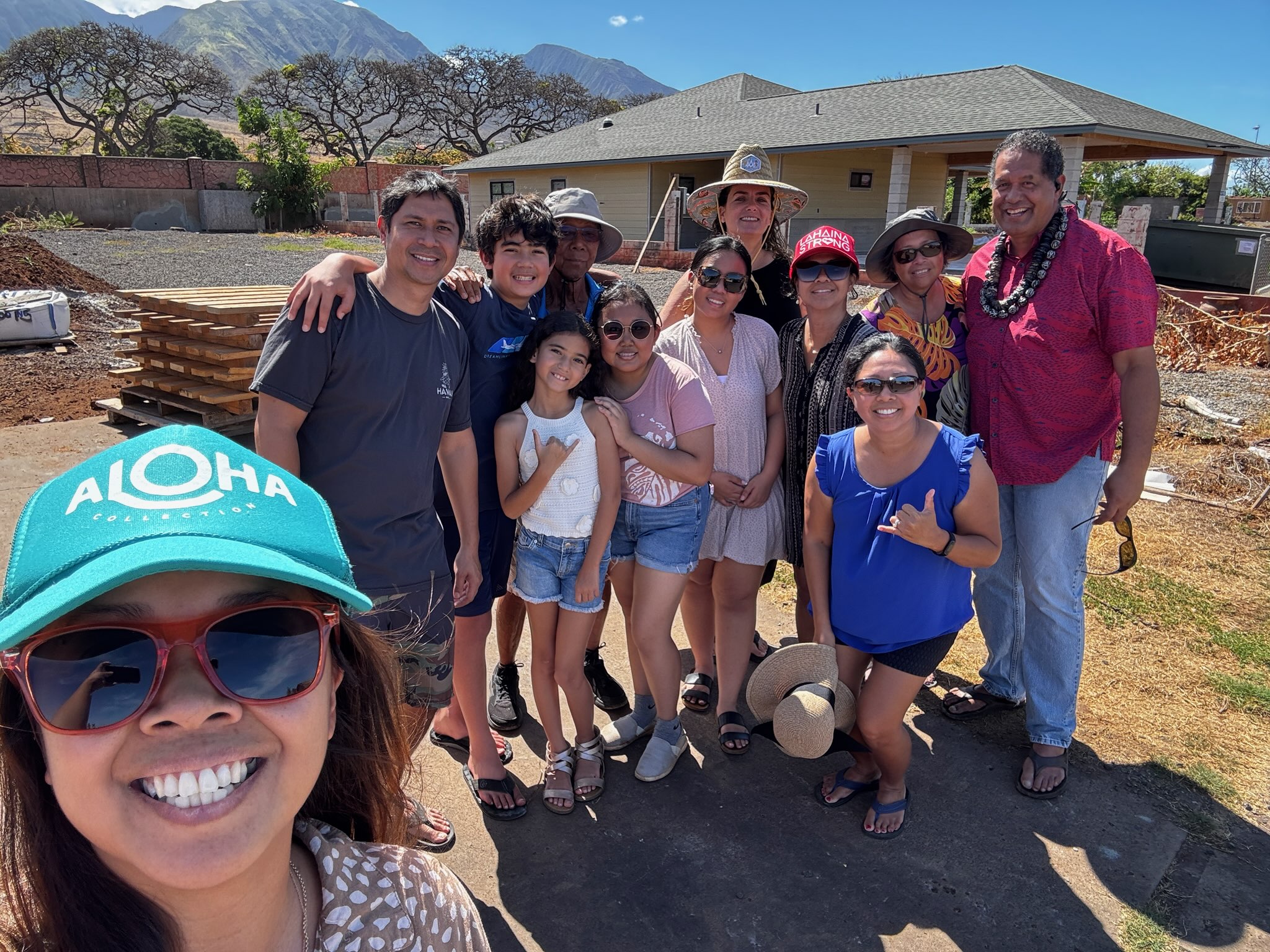

Durbin’s ‘ohana is also eager to stop renting and return to their home on Waineʻe Street, which has been owned by her parents, Juan and Frances Asuncion, since 1980. Seven family members once lived in the home. Now they’re spread out in three rental units in Lahaina, Kahului and Kīhei, paying close to or just over $3,000 each. It’s money that could be going toward their new home, said Durbin, who lives in Oregon and comes back every month to help out her family.

The Asuncions were underinsured and spent most of their insurance payout on the mortgage for the burned-down home. Now, the funds that could have been used to replace their personal property are going toward the rebuilding of their three-bedroom, three-bathroom home and two-bedroom, one-bathroom ‘ohana unit.

Even with the $500,000 Small Business Administration loan, they’re short about $400,000 for the $1.3 million cost of constructing both.

“It’s like, do we want a house or do we want material things?” Durbin said. “We want the house, so … we’ve just been holding on to everything, because we knew that things were just going to get costly.”

Durbin said it would be “huge” for the family to get help with reconstruction so they can return home. They wouldn’t have to drive so far for work and school, and the kids could join their friends for afterschool activities at Lahainaluna High School. Most importantly, they’d get the benefits of being together for nightly family dinners, shared living costs and help with childcare.

“Every day I’m thankful for my family and where I’m from, but this disaster, I think, it’s just kind of opened my eyes as far as like, life’s short, life’s precious, so I’m looking into ways to get back (to Maui),” Durbin said.

They recently held a blessing on their property with the goal of starting construction by October.

FILLING THE GAP

Residents who have been able to rebuild thus far have had to dip into their own pockets or relied on assistance from nonprofits. Kim Ball, who sits on the mayor’s Lahaina Advisory Team, declined to share what he got from insurance but said that he and his wife had to use their retirement funds to rebuild their Komo Mai Street house. They started in May 2024 and expect to be finished “any day now.” Recently, they went shopping for kitchenware, bath towels and other home goods.

“It’s almost like being a newlywed, starting all over,” he said.

Ball said he and his family have considered applying for the reimbursement program, depending on whether they can get a Small Business Administration loan, but “we haven’t decided yet.”

“You always think there’s someone more deserving than you,” Ball said.

Brandy Cajudoy, co-owner of Cajudoy Construction, said residents who are rebuilding are currently looking at costs of $350 to $400 per square foot. For a 1,600-square-foot home, which she said is roughly the median size of a home on Maui, that’s about $640,000. Rebuilding a home and a cottage could set someone back $1 million.

Many people are getting much less than that from their insurance companies, and some are still paying mortgages on homes they lost in the fire.

“Almost everybody has a gap,” said Cajudoy, who’s also the Construction Committee lead for the Ho‘ōla iā Mauiakama Disaster Long Term Recovery Group. “If they don’t have a gap, then they were able to reassess their insurance at one time or another.”

Nearly a year after the fire, $3.3 billion in total damages had been reported, and $2.3 billion for 10,033 claims had been paid out, leaving a gap of about $1 billion, according to data from more than 200 insurers released by the state Insurance Division.

Half of the damages — about $1.6 billion — were for residential properties, with just under $1.4 billion paid out for 5,239 claims. That left a gap of about $200 million, averaged out to just over $260,000 per claim.

The recovery group has been working with Hawai‘i Community Lending, the Lahaina Community Land Trust and Habitat for Humanity Maui to help people afford to rebuild.

Hawai‘i Community Lending, which does the intakes, has about 500 households in the pipeline, said Rhonda Alexander-Monkres, executive director of the recovery group. The organizations work together to review applications and decide what resources could best help each applicant fill the funding gap, whether that’s grants, discounts or “creative financing.”

Currently, they’re working with Mennonite Disaster Service to build five homes, with the survivors paying for materials and the disaster service offering free labor.

Alexander-Monkres said that the federal disaster funds “are much needed.” She said one of the biggest barriers that people face is the pre-development costs, such as permitting and architectural design, that can range from as little as $3,000 to $140,000. The other big challenge is navigating the process of building a home and competing for contractors and materials with the rest of the town.

“Everything, every day, is not quick enough for anyone who sits in that survivor seat,” she said.

Last year, the Maui County Council set aside $3 million for the Lahaina Community Land Trust to provide insurance gap funding for fire survivors. This year, they approved another $6 million, with the allocations for land acquisition and insurance gap funding to be determined.

Autumn Ness, executive director of the land trust, said the important thing is making sure that people are able to stay in their homes once they rebuild them. The land trust was created after the fire with the goals of helping residents afford to stay in Lahaina and buying properties from those who chose to sell but didn’t want off-island investors to scoop up their land.

Ness said the disaster grant would help the recovery “a thousand percent,” but she said there need to be protections in place to ensure that the county doesn’t spend $1 million in public funds to rebuild a home that could later be flipped if the market went crazy. She pointed to the example of New Orleans, which received billions in federal funding after Hurricane Katrina in 2005, only to have home prices skyrocket, its population decline and gentrification increase in the decades after.

She suggested that Maui County put requirements on the funding, such as deed restrictions that would ensure the homes are owner-occupied and come with a base price that can only appreciate at a certain amount every year so that when they’re sold to another Lahaina resident, they will be affordable.

The insurance gap program the land trust oversees provides funding assistance to residents who agree that the home will only ever be sold to kama‘āina at an attainable price.

Ness said the land trust and other organizations that have been working with people to rebuild their homes and keep them affordable and locally owned have created a “well-oiled machine,” and if the federal disaster grant programs become “a whole other engine,” it could impact the protections they’re trying to create for Lahaina.

“Is this funding going to be used the way the community has decided it wants to be used, which is keeping us home now and solving Lahaina’s housing problem?” Ness said.

The Office of Recovery said it is currently finalizing the policies that applicants will have to follow for each program.

Maui County plans to host in-person and online meetings on the programs this week, with presentations followed by question-and-answer sessions and an opportunity for one-on-one discussions at the in-person meetings.

On Wednesday, meetings will be held in person at the Lahaina Civic Center social hall, with information on the first-time homebuyers program at 5 p.m., the single-family homeowner reconstruction program at 6 p.m. and the homeowner reimbursement program at 7 p.m.

On Friday, meetings will be held via Zoom, with the first-time homebuyers program at 3 p.m., the single-family homeowner reconstruction program at 4 p.m. and the homeowner reimbursement program at 5 p.m.

More information and a registration link for the Zoom meetings is available at www.mauirecovers.org/cdbgdr#1-Single-Family-Homeowner-Reconstruction-Program.