New Federal Pandemic Aid Available to Maui County’s Small Businesses

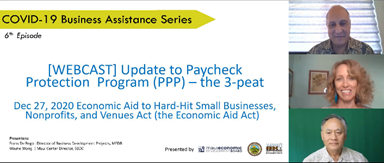

The Maui Economic Development Board held a recent webcast to update more than 220 small business owners about the new round of federal aid for the Paycheck Protection Program and Economic Injury Disaster Loan.

It was the sixth presentation of the free COVID-19 Business Assistance Series, sponsored by the County of Maui. The speakers were Frank De Rego, Jr., Director of Business Development Projects for the Maui Economic Development Board (MEDB) and Wayne Wong, Director of the Hawaii Small Business Development Center (SBDC).

The Economic Aid Act approved December 27, 2020 allows for another $284 billion in PPP forgivable loans — specifically designed to provide job retention (payroll costs) and some limited other expenses. Key updates to the PPP include:

- Covered period can be any length between 8 and 24 weeks to best meet business needs

- Allows additional expenses: operations expenditures, property damage costs, supplier costs and worker protection expenditures

- Eligibility expanded to include: 501(c)(6)s, housing cooperatives, direct marketing organizations, among other types of organizations

- Greater flexibility for seasonal employees

- Certain existing PPP borrowers now eligible to apply for a Second Draw PPP Loan

- Clarifies that forgiven PPP, for tax purposes, is not taxable gross income. Also, any otherwise deductible expenses paid with the proceeds of a forgiven PPP funds remain deductible

De Rego and Wong discussed and answered questions on eligibility requirements, what the funds can be used for, forms and documents required, and how the loan forgiveness works. Applications for first and second draw PPP loans opened Jan. 19 and run through March 31, 2021 with participating lenders.

A further $20 billion was added to the EIDL Advance (Grant) program and applications can be accepted through December 2021. This is available for business owners who have not already received $10,000 in EIDL advance AND are located in a low-income community, have suffered an economic loss of greater than 30 percent, and employ less than 301 employees. The EIDL Advance application process is still being worked on by the Small Business Administration and is at least another week or two away.

“I always appreciate MEDB’s webinars, they are timely, have good understanding of the subject and very helpful on staying on top of the current laws/regulations.” said Missy Dunham, a Maui-based bookkeeper and regular participant in the COVID-19 Business Assistance Series.

A replay of the webcast is available, including participating lenders, important links and the slide deck at www.mauibizassist.com. Answers to the many questions asked during the call also have been posted.

The COVID-19 Business Assistance Series helps Maui County small business navigate the resources available to them, with clear step-by-step instructions. More topics will be explored to adapt to the changing landscape as we pull together to meet the challenges facing all of us