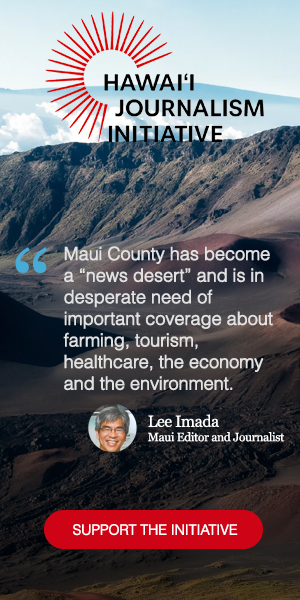

Hawai‘i Journalism Initiative

Hawai‘i Journalism InitiativeMaui County trying to collect millions in overdue visitor lodging taxes

Hundreds of property owners who have failed to pay Maui County the 3% transient accommodations tax for visitor lodgings have been receiving letters saying they need to pay up, and fast.

In November 2021, Maui County started charging the tax after the state took away the counties’ share of the statewide pot. Each county was allowed to impose its own tax on top of the state’s rate of 10.25%.

HJI Weekly Newsletter

Get more stories like these delivered straight to your inbox. Sign up for the Hawai‘i Journalism Initiative's weekly newsletter:

But since then, the county has struggled to collect millions in those taxes, according to a recent audit. Now, the county is trying to recoup those overdue payments. The 1,223 letters sent by the county in late September and early October said that property owners need to pay the overdue taxes within 15 days or request an exemption for reservations that were made before the tax took effect.

If the taxes aren’t paid, the county may ask the court for an injunction that would keep owners from operating a vacation rental.

“The letters that have been sent out were the first two of many increments that will go out through the end of the year to assess on delinquent MCTAT (Maui County transient accommodations tax),” Department of Finance Deputy Director Maria Zielinski said in an email on Friday.

This comes at a time when the Maui County Council is on the verge of considering a proposal by Mayor Richard Bissen to phase out short-term rentals to create more housing in the wake of the 2023 wildfires.

But Zielinski says that’s not why the department is seeking the overdue taxes now. When asked what would happen if short-term rentals were phased out before the county could collect all the taxes, Zielinski said the two issues are unrelated. Property owners still owe taxes on money they make from operating a short-term rental, even if they sell the unit. Under state law, the county has three years to assess and 15 years to collect the tax.

Kari Alexander, an accountant with Sullivan Properties in Kahana, said 13 of her clients received letters seeking overdue transient accommodations taxes owed for bookings in November and December 2021, the first months that the tax applied. Some were told they owed thousands in taxes — as much $7,000 for one client and $10,000 for another, an indication of just how strong business was in late 2021 after the shutdowns of the first year of the COVID-19 pandemic.

Alexander, who handles the tax filings for all of her clients, said it wasn’t hard to address the issue. It mostly involved asking for exemptions and providing records for property owners who had bookings made prior to November 2021. According to the letters, the exemption was not automatically applied.

“I think the county is trying to collect all that they can in tax revenue because of the fire, and some people are pushing not to have vacation rentals, which is sad, because that’s our livelihood,” Alexander said. “So now they’re trying to collect wherever they can on taxes because they need that money.”

In December, Maui County Auditor Lance Taguchi published a report that found more than $9.3 million in Maui County transient accommodations taxes was delinquent as of June 30, 2022, and that the county had “made little to no effort to collect it.”

Maui County had expected to get more than $56.9 million in county transient accommodations tax revenues in fiscal year 2022, which ended July 1, 2022. However, only $40 million was actually deposited into the treasury, forcing the county to correct its financial statements.

Part of the problem was that the department had referred to the new fee as a “voluntary tax,” which it later acknowledged. The other problem was that the county wasn’t prepared to collect the tax when it took effect, lacking the staffing and the software to do the job. As of April 2023, the department had only filled two of the eight positions set aside to handle the county transient accommodations tax collection, the report found.

Zielinski said Friday that six of eight positions have now been filled, which has helped with collecting taxes and compliance. She did not have the current amount of overdue taxes because the department is still working to calculate that total.

Maui County only receives a payment voucher from its taxpayers, she explained. It now is reconciling those payments to the state’s monthly and annual reconciliation returns filed by taxpayers since the beginning of the 3% tax.

“Once the analysis is complete, we will have the needed data to determine the amount that is overdue,” Zielinski said.

Revenues from the county transient accommodations tax go into the county’s general fund. Last year, the county collected about $20 million over the budgeted amount for transient accommodations taxes, so “operations were not impacted” by the overdue taxes, Zielinski said.

It’s unclear how much the county could lose if all short-term rentals are phased out. One study by the Travel Technology Association and Hawai’i economic consultant Kloninger & Sims estimated that the county could lose anywhere from $128.3 million to $280.9 million in real property taxes, transient accommodations taxes and general excise taxes combined. The mayor questioned the study’s figures given its interest in the short-term rental industry; Maui County is awaiting the results of its own study.

Tom Croly, who runs a bed and breakfast on his property in South Maui, avidly tracks county legislation related to vacation rentals and is up to date on his transient accommodation tax payments.

But he says some people may not have known about this tax because it took effect just one month after it passed on Oct. 1, 2021. He said there may also be confusion because some property owners do their bookings through external sites like Expedia or through management companies, and they may be under the impression that those third parties will be paying the taxes.

Croly has been operating a bed and breakfast for 22 years and has accepted the new tax — “it is what it is” — but said it’s been tougher as state and county tax rates keep increasing.

Normally at this time of year, his bookings would be 70% full for the winter and early spring; now, he’s at 20%. While a big part of the fallout is from the decline in tourism since last year’s wildfires, he adds that the new tax hasn’t helped, bumping the taxes on his bookings to nearly 20% for guests.

Croly is “not in full panic mode” yet over his drop in bookings because he knows they will climb once colder weather hits the Mainland.

“But I definitely recognize the fall-off in business coming to Maui specifically, and coming to our B&B from a personal level,” he said. “Now, can I blame that on the taxes? Maybe a little. Can I also blame that on the fires? Maybe a lot.”

But, he says, he also blames the decline on the funding cuts to state and local tourism agencies.

Alexander, whose family is rebuilding the home they lost in the Lahaina fire last year, said owners are feeling the pinch more because bookings have declined since the fires, and some have switched their condos from short-term to long-term rentals for survivors whose homes burned down. Visitor arrivals to Maui are also well below what they were prior to the fire.

“Owners aren’t questioning it (the taxes) when there’s a ton of bookings,” Alexander said. “But now that there’s not a ton of bookings, now they’re like well, wait, I don’t want that 3%. I don’t want to pay that.”

But Alexander said it’s also on property owners to keep track of the taxes they have to pay.

“You can’t blame everything on the county or the state,” she said.