County 2015 Budget Calls for $150.8M in Capital Improvements

[flashvideo file=http://www.youtube.com/watch?v=9MrCMCU6Lc8 /] By Wendy Osher

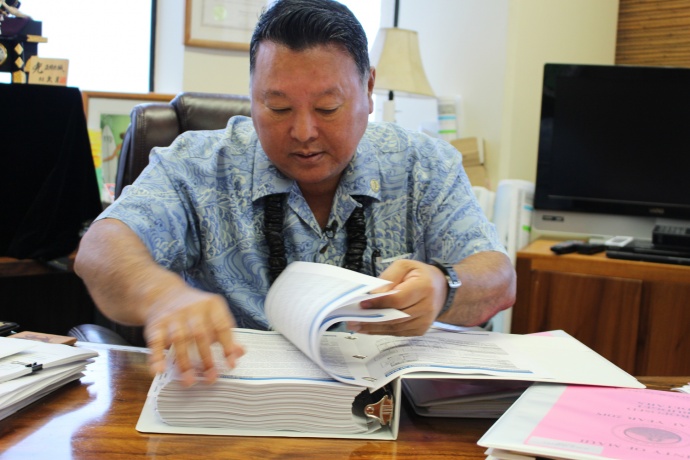

Maui Mayor Alan Arakawa unveiled his proposed budget for the 2015 fiscal year before the Maui County Council today.

The mayor said the $687 million budget “hinges on whether or not the state is going to remove the Transient Accommodations Tax cap” that was imposed by the state a few years back to assist with a deficit.

“If they don’t remove the cap, then we’re going to have to ask the community for a property tax increase of 6.7%. If they remove the cap, we can actually ask the council to not raise any of the property taxes and actually possibly reduce some,” Mayor Arakawa said in a pre-event interview.

According to the mayor, the 2015 budget request is $63.3 million more than last year, which translates to an 11.3% increase.

Below is the full text of the Mayor’s Budget Address to the council:

“Aloha and good morning Council members. Aloha to you Council Chair Pro Tem Mike Victorino and to Council Chair Gladys Baisa and Vice Chair Bob Carroll who are watching from Hale Makua.

Today I present to this council and our community the administration recommendation for Maui County’s budget for fiscal year 2015.

Total spending in this budget for Fiscal Year 2015 is $622.6 million, and includes an operating budget of $509.9 million.

This is a balanced budget that continues to strengthen the county’s fiscal health as well as invests in our future.

As you know, this is not a new concept. Every budget that we have presented over the last four years has had this same focus.

Consider that fact as you look over this year’s budget, and remember that this is all a work in progress.

Everything that we have been doing, all the projects that we have broken ground on and plans that we have made, at some point will have a cumulative effect upon this community.

In fact, you should be able to see some of that effect already.

Our roads are being maintained on a faster schedule, our water system efficiency is improving, our wastewater system is of a higher quality and our park facilities are getting better and better, even if we have to fix them restroom by restroom.

Improving our infrastructure has always been an important priority, and will be again for FY15. Just looking at our Capital Improvement Program project spending you will see that infrastructure improvements make up about 80% of the CIP.

This year’s CIP proposes a total of $150.8 million in capital projects. They include:

- $26.2 million for road resurfacing and improvements, not including the work done by our in-house road paving and preservation crew;

- $21.8 million for Water Supply improvements, including source development, storage and transmission upgrades and repairs;

- $21.2 million for Wastewater improvements and expansion, including recycled water, sewer lines, reclamation facilities and pump stations;

- $27.3 million for Parks facility improvements, including $16.3 million for a much needed gym for South Maui;

- $28.5 million for other projects, including $11.4 million for affordable housing, $7.2 million in equipment and $7.1 million for expansion of the Kula Agricultural Park;

- $13.1 million for Government Facilities, including $1.3 million in design funds for a new consolidated baseyard in Waikapu, and $7.5 million for construction of a new Public Works baseyard on Molokai;

- $10.7 million for various drainage improvement projects, including $8 million for continued work on the Lahaina Flood Control Project.

All these projects mean that we are continuing to invest in infrastructure improvements today so that we do not have to pay

excessively for infrastructure replacements tomorrow.

Again, this is a work in progress. All we ask is for you to help us to provide the infrastructure that the community wants by giving us the resources that we need to make it all happen.

This budget also continues to take care of our fiscal obligations on a timely manner, so that we have a financially sound foundation.

It continues to pay for our debt obligations, unfunded liabilities and post-employment benefits. At the same time we also continue to retain our nearly Triple A bond ratings from Standard and Poor’s, Moody’s and Fitch, which are still the best in the State of Hawaii.

We are also making sure that our debt service stays low. This year the amount required for our debt payments decreased from 8% of the county’s budget to 7.6%.

This means we pay less interest on the money we borrow to finance our projects, which saves taxpayer money all around.

This budget also takes into consideration that we must pay for negotiated and arbitrated union employee payraises, which, including fringe benefits, comes out to more than an $18 million dollar increase over last year’s adopted budget.

We are also bound by amendments to the County Charter in 2012 to move the Ocean Safety Division from the Department of Parks and Recreation to the Department of Fire and Public Safety. Another charter amendment adds the responsibility of sustainability to the Department of Environmental Management.

We are also continuing to support our community through our non-profit organizations, which handle many social issues that the county would have to otherwise take care of ourselves.

This budget proposes approximately $27.2 million dollars in grant subsidies, an increase of $5 million dollars. Of that amount, $4.4 million is for non-profit capital projects such as Lanai’s new youth center.

We are doing all of this to create the community that people want, with the services that some need very badly need.

All the while we continue to make critical investments to our infrastructure and have tried to keep the burden off of our residents as much as possible. That is what our visitor industry is supposed to be for, to help pay for this community’s infrastructure costs.

I feel I must point out that if the state had not imposed the Transient Accommodations Tax, or TAT, cap, we would not have had to raise property taxes last year, nor would we have to raise them this year.

But with the cap, we will be asking for a 6.5%across the board property tax increase.

Again, if the state removes the cap, there will be NO property tax increase.

We know the State of Hawaii has had some budget challenges, but they must keep the TAT in the counties where it belongs. It was generated by our people working hard in our visitor industry and it was meant to pay to upkeep our infrastructure, which is impacted by millions of visitors every year.

Our Maui legislators have already done so much for the county this year, by securing more than $460 million in state CIP funding for various projects. This includes $130 million for the construction for a new Kihei High School, which the community has been wanting for years now.

And yet we must ask them to go even further, and to fight for the citizens of this community once more.

We need the TAT, but not just to pay for our infrastructure. It’s a matter of principle.

Maui has won the “Best Island in the World” title from Conde Nast for 20 years now.

Usually we have several of our beaches ranked top three in the nation as well as some of our resorts and restaurants.

In other words, we’ve earned that TAT and we need it to maintain the level of excellence that our visitors have come to expect.

We ask that the state continue to show their strong support for us, just as our council and this community have been working with us diligently.

We can accomplish all we need to accomplish; we just need the resources to do so.

But most of all we need to work together. And despite our spirited discussions in the past, we have always managed to find a way to do just that.

Please do not hesitate to call upon myself or my staff to answer any questions you have about the budget.

Mahalo for listening, and thank you once again for making Maui County one of the best communities in the world.”

***Video clip courtesy County of Maui.