Hawai‘i’s Moving Violation Penalties Among Nation’s Highest

A newly released study conducted by insuranceQuotes analyzed auto insurance rates across the country and found that Hawai‘i’s moving violation penalties are among the highest nationwide.

A newly released study conducted by insuranceQuotes analyzed auto insurance rates across the country and found that Hawai‘i’s moving violation penalties are among the highest nationwide.

Insurance rates rose by 290.68% in 2016 for reckless driving, gaving the Aloha State the No. 1 ranking in the nation.

Hawai‘i ranked No. 2 in the nation for DUI/DWI infractions with an increase of 293.79%. Only North Carolina ranked higher with an 333.85% increase.

The state ranked seventh in the nation for speeding 31 miles per hour or more over the speed limit. Illinois, Michigan, New Jersey, North Carolina, Delaware and Oregon took the top six spots respectively.

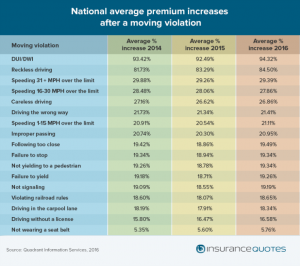

The new data also shows shows that nationwide, while serious violations such as driving under the influence and reckless driving cause car insurance rates to spike, minor violations hurt consumers’ finances as well.

Go online to see complete state rankings.

Report Highlights

· Drivers who receive a minor speeding violation (1 to 15 mph over the legal limit) pay an average of 21% more for car insurance.

· Other fairly minor violations that also carry high financial penalties include following too closely (19% increase), failure to signal (19% increase), and improperly driving in a car pool lane (18% increase).

· The most expensive violations are DUIs (94% increase) and reckless driving (85% increase). The least expensive is not wearing a seat belt (6% increase).

· Rate increases differ from state to state. For instance, Hawai‘i has a 290.68% rate increase for reckless driving; whereas reckless driving in Louisiana leads to a 29.28% increase.

The report also includes tips from insuranceQuotes analysts on how to save money once drivers have received a moving violation, such as seeking forgiveness from auto insurers for a first-time minor infraction, making a deal at traffic court and even shopping around for a new car insurance policy to find a cheaper alternative.

“Even though rates typically go up for several years after you receive a moving violation, there are ways drivers can save money,” said Laura Adams, senior analyst at insuranceQuotes. “Taking a defensive driving course to remove points from your record is a smart strategy.”

“Many of these courses are offered online and can be completed in just a few hours,” Adams said. “You can also enroll in a pay-as-you-drive insurance program, which gives discounts when you demonstrate safe driving behavior.”

As a complement to the study, insuranceQuotes hosts a Traffic Tickets and Car Insurance Calculator that shows how 17 different violations affect rates across the country.

Methodology

insuranceQuotes and Quadrant Information Services calculated the economic impact of 17 common moving violations using data from the largest carriers (representing 60 to 70% of market share) in each state and Washington, DC.