Study: Americans Paid Off Record $82.9 Billion in Credit Card Debt During 2020

Despite the COVID-19 pandemic leading to massive unemployment in the United States during 2020, Americans paid off a record $82.9 billion in credit card debt, according to the latest Credit Card Debt Study by the personal-finance website WalletHub.

Analysts of the Credit Card Debt Study said the reduction is a major accomplishment considering consumers have added an average of $54.2 billion in credit card debt per year over the past 10 years.

“The latest credit card debt statistics tell us that American consumers are actually getting healthier financially in some respects because of the coronavirus pandemic,” said Jill Gonzalez, WalletHub analyst, in a news release. “We paid off a record $82.9 billion in credit card debt during 2020 – just the second time in the past 35 years we’ve even ended the year owing less credit card debt than we started with.

“Paying off so much credit card debt indicates that consumers have been making the most of the pandemic, by using the stimulus money and COVID restrictions to make their finances more sustainable.”

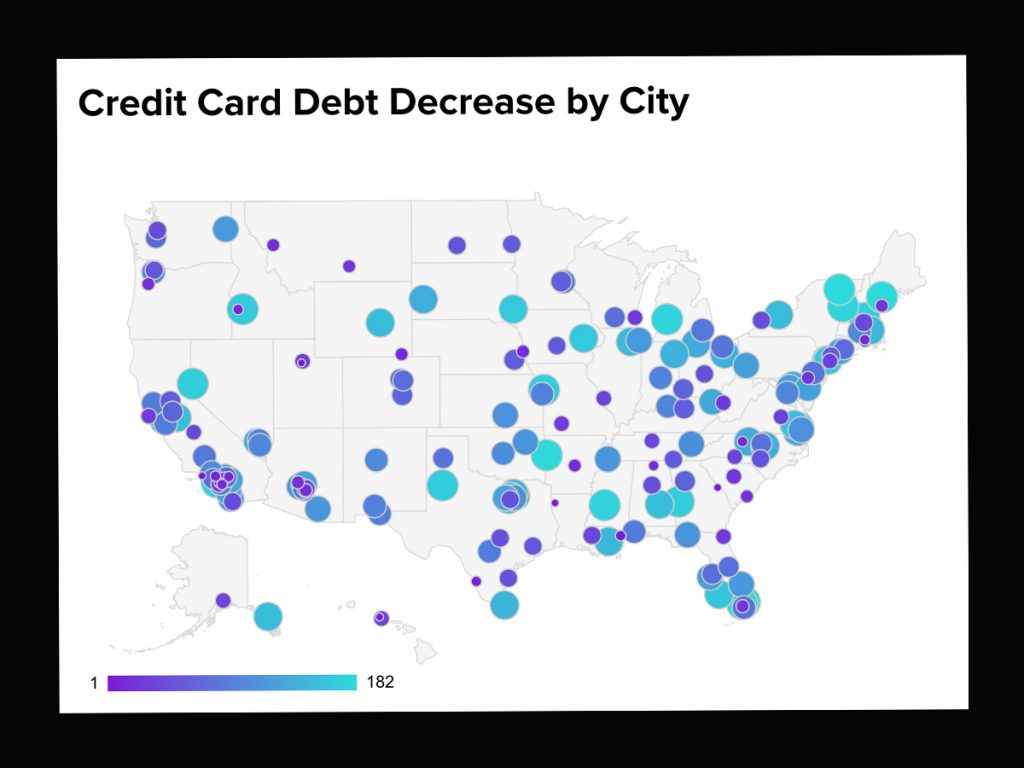

Pearl City on Oʻahu was ranked fourth in the nation for cities with the biggest debt paydown by its households, with an average decrease of $1,147, according to a recent study.

But Pearl City, an unincorporated community in Honolulu County, still has an average household credit card debt of $17,034, which is well above the national household average of $8,089 for the fourth quarter of 2020.

The top city was Oxnard, CA, with an average household debt decrease of $1,270, followed by West Valley City, UT ($1,234) and Augusta, GA ($1,184).

“WalletHub is projecting that consumers will add around $50 billion in credit card debt during 2021,” Gonzalez said. “A short-term burst of spending is inevitable as pandemic restrictions are lifted. The question is which way the pendulum swings in 2022 and beyond. My hope is that consumers will internalize lessons learned during the pandemic and showcase a newfound frugality.”

Credit Card Debt Study Key Stats:

- Consumers repaid almost $83 billion in credit card debt during 2020 – an all-time record.

- The average household credit card balance was $8,089 at the end of 2020.

- Credit card debt rose by $36.7 billion during Q4 2020 – the lowest increase in 10 years.

- Credit card charge-off rates are down 24.3% compared to Q3 2020.

- The best balance transfer credit cards currently offer 0% APRs for the first 12-20 months with no annual fee and balance transfer fees as low as 3%.

Credit Card Debt Survey Key Findings

- Few plan a post-pandemic shopping spree. More than 1 in 10 people plan to go on a spending spree when the COVID-19 pandemic is over.

- COVID is an obstacle to debt. Almost 35% of Americans say that COVID-19 made it harder to get into serious credit card debt.

- Men feel less debt stress. Women are 37% more likely than men to feel stressed about credit card debt.

- Most agree, healthcare is debt-worthy. 60% of Americans say that healthcare expenses are worth going into credit card debt.

- Fighting back against high rates. 66% of people will try to lower the interest rate on their credit card debt in 2021