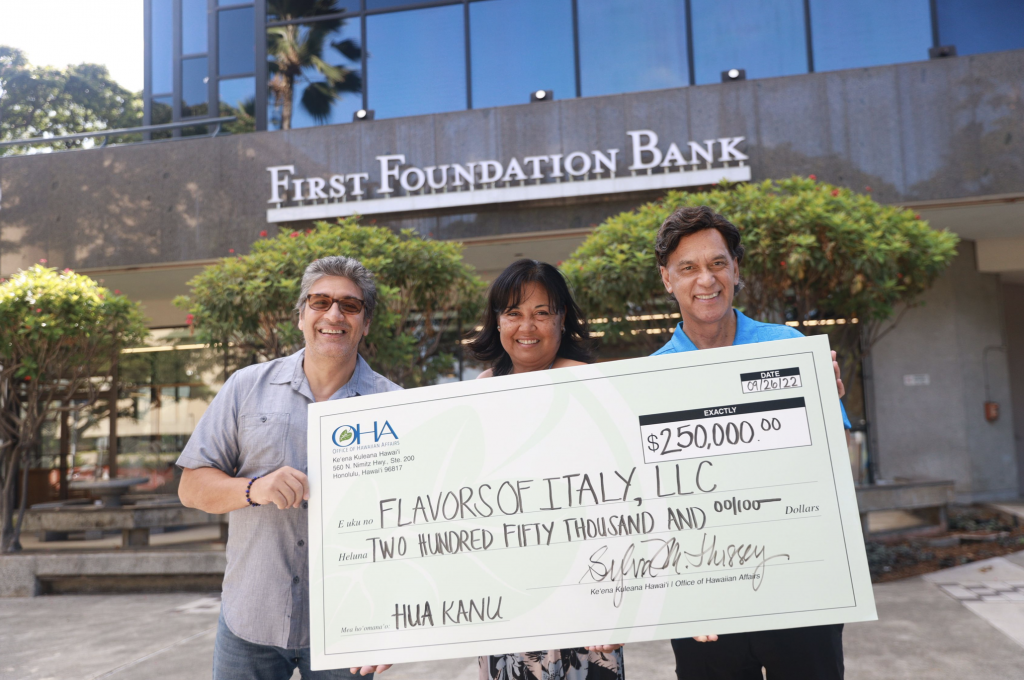

Woman-owned business receives $250,000 loan from Office of Hawaiian Affairs

Flavors of Italy, a Native Hawaiian, woman-owned business, has been issued a $250,000 Hua Kanu loan through the Office of Hawaiian Affairs’ Mālama Loans program.

Desiree Kanae Loperfido, a Department of Hawaiian Home Lands beneficiary, and her husband, chef Donato Loperfido, operates the business that imports and distributes alcohol and specializes in a wide range of wines and cheese.

A loan signing ceremony was held Sept. 26 at First Foundation, OHA’s financial lending partner, in Kakaʻako.

“What makes Flavors of Italy such a good candidate for this loan is the strength of their business which has been in operation since 2005,” said Aikūʻē Kalima, OHA’s Mālama Loans manager. “Desiree and Donato have direct ties to Italy, which allows the business to import and distribute products competitively.”

Flavors of Italy, located in Honolulu, supplies it products to local restaurants, hotels such as the Four Seasons and to grocery stores including Foodland and Whole Foods Market. The company has grown from a humble start in 2005 when they imported just one pallet of goods to today where they currently bring in eight to 10 containers of wine and cheese each year.

Desiree Loperfido said the company will use the loan funds to expand the business by building inventory and purchasing additional equipment. The business is also expected to start manufacturing cheeses such as fresh mozzarella, eliminating transportation and shipping costs, and making Hawaiʻi more sustainable.

Loperfido, born and raised on a Nānākuli homestead, said she attended training on how to apply for a Mālama Loan years ago, and remembered the OHA program when they were looking to build their business.

“I spoke with my husband, and we decided to reach out to OHA and see if they could help us because we need that extra money to expand our business,” she said. “The interest rates are great, and we are very appreciative of what OHA and its Mālama Loans program does for the Hawaiian community. We’re grateful for the help, because we really needed it.”

OHA Board Chair Carmen “Hulu” Lindsey said one of the agency’s strategic objectives is to increase the number of business loans to Department of Hawaiian Home Lands beneficiaries who are interested in starting a new business, or provide working capital to existing business owners.

“We’re trying to assist these beneficiaries by increasing their financial capabilities and building economic self-sufficiency, and this business loan to Flavors of Italy is a great example of that work,” Lindsey said.

OHA’s Hua Kanu Business Loans offer highly qualified business owners seven-year low interest rate loans ranging from $150,000 to $1 million, while Mālama Business Loans target startup and small businesses with loans of $2,500 to $149,999.

Mālama Mahi ʻAi Agriculture, Mālama Home Improvement, Mālama Debt Consolidation and Mālama Education are the other OHA programs that comprise the Mālama Loans program.

OHA’s Mālama Loans program tap into a federal funding stream available through the Administration for Native Americans and makes the federal funds available locally to Hawaiians to expand their businesses, improve their homes and help pay for educational expenses.

Learn more about OHA loans at oha.org/loans or call 808-594-1924.