Bill to accelerate property tax relief hits speed bump

A proposal to provide expedited property tax relief to local homebuyers stalled Tuesday after Maui County finance officials cautioned that the county’s tax system is designed to be “retroactive” and cannot easily handle mid-year adjustments for now.

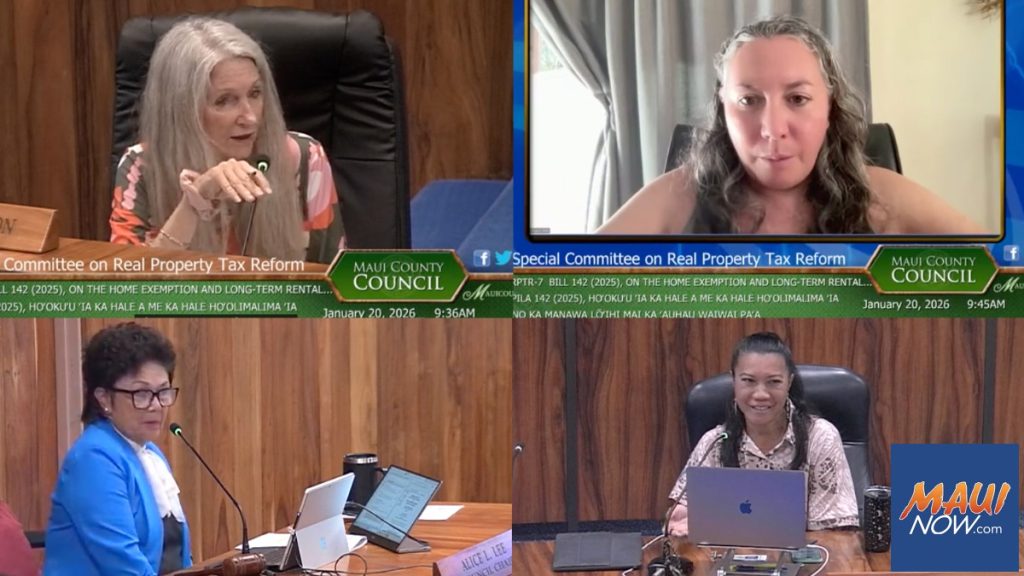

The Maui County Council’s Special Committee on Real Property Tax Reform, chaired by Council Chair Alice Lee, deferred action on Bill 142. The measure, introduced by Council Member Tamara Paltin, sought to allow residents who buy homes to qualify for the lower “owner-occupied” tax rate on their next tax payment, rather than waiting up to 18 months for the next tax cycle.

The text of the measure says: “Claimants who file their applications by either Dec. 31 or June 30 will receive their entitled exemption on their next tax payment, providing a clear and predictable process for receiving a tax reduction.”

Who stands to gain?

The primary beneficiaries of the proposal would be local families and long-term residents.

Paltin’s proposal aims to make it easier to qualify for a home exemption by reducing the required length of county residency from 10 to five years. It also seeks to remove a rule requiring a house to have been a vacation rental in the past to qualify for special consideration. And, it would allow those who file by the deadlines to get their tax break immediately on their next payment.

Administrative hurdle: Timely relief versus ‘retroactive’ system

However, Tuesday’s committee discussion revealed a gap between the measure’s goal for timely relief and the Department of Finance’s technical and staff limitations.

Finance Director Marcy Martin told the committee that the county’s real property tax system is designed to provide a “stable, predictable, inelastic source of revenue,” based on a snapshot in time.

She explained that: “All of our tax relief programs are retroactive, almost like a reimbursement, right, as of a date, then you’re taxed later. And you’ve done something, and then you’re compensated for that something in the next year. The entire program is based upon that.”

Martin said that changing the system to allow mid-cycle adjustments would require significant resources.

“If we were to invest an incredible amount of money into staff and software, we could, you know, probably do that,” Martin said. “But we as government, need to balance how we make that work, and what is most feasible to charge everyone in order to fund the systems that we have in place and to make it as fair as possible.”

She said what’s being suggested is “giving somebody something the day that they buy,” which is “more like giving them money because they’ve promised to do something that they really don’t qualify for… We don’t want to give somebody $10,000 and have them own it for one day and owner-occupy it one day, then the next day, turn around and do another activity.”

“You kind of want to hold them accountable so that it’s fair to all the people who are already in the system,” Martin said.

Retroactive delay impacts struggling residents

However, the system’s current delay in tax reclassification has real-world consequences.

Testifiers at the meeting expressed frustration. Tom Croly, who served as a committee resource, said the current system can result in tax bills being “wrong” for up to 18 months.

Paltin cited an example of a Lahaina fire survivor whose condominium is being rebuilt, but needed to move off island “because they couldn’t make it here.”

She noted that residents, including those whose families have lived on Maui for generations, encounter similar situations and often pay the higher “non-owner occupied” tax rate on their properties while they wait for the paperwork to catch up with their current living situation.

“Everyday people with lives and families have a hard time keeping up with this stuff,” she said.

A round peg into a square hole

Committee Vice Chair Keani Rawlins-Fernandez summarized the dilemma, noting that while the department supports the concept of helping residents, the current bill might be trying to fit “a round peg into a square hole.”

“We need to figure out a better mechanism for achieving what it is that we’re trying to do,” she said.

Lee acknowledged that the committee is asking for a fundamental shift in how the County operates.

“They wanted us to make the changes within the framework they already have,” Lee said, referring to the administration. “We are saying, ‘Let’s change the framework. Let’s create something different.’ And so that’s the hard part, because we don’t do that on a daily basis.”

Alternative solutions

Council Member Gabe Johnson suggested creating a separate “supplementary fund” to subsidize the difference in taxes for new local homeowners, rather than trying to alter the tax software itself.

Martin indicated the department would be willing to look into that idea but noted it would likely fall under housing programs rather than real property tax administration. And, it would require a change in the County Code.

Paltin suggested considering a deferment of taxes for the first 18 months, modeled on the practice of not taxing new Department of Hawaiian Home Lands lessees for seven years.

“I think that’s something we had talked about in the past, and I think we can present a scenario for you all to look at,” Martin said. “We would be willing to do that.”

Legal and policy risks

The bill faces more than just technical challenges. Waikapū resident Jolee Bindo submitted written testimony warning that the bill’s residency requirements — whether set at five or 10 years — could be unconstitutional.

Bindo pointed to US Supreme Court cases that prevent governments from favoring long-term residents over new ones without a “compelling justification.” She cautioned that passing the bill would invite “predictable” federal lawsuits.

Maui resident Edward Codelia also raised concerns that the revised bill has moved away from its original goal of encouraging the conversion of vacation rentals into housing. He argued that the new draft “quietly eliminates” incentives for long-term rentals by removing their ability to get faster tax relief.

Codelia recommended that the committee add a “sunset clause” to the bill so the policy would automatically expire after three years, ensuring a temporary recovery measure does not become a permanent structural tax change.

Legal drafting issues complicate matters

In addition to the software and system issues, the committee’s deferral was necessary for legal reasons. Peter Hanano, a legislative attorney with the Office of Council Services, advised the committee to pause because the current version of the bill was missing a key section of the legal code required to make the law effective.

Committee members agreed without objection to defer the bill to give the administration more time to find a workable solution.