Tiny Taxes for Ag-Zoned Properties Raises Questions

By Wendy Osher

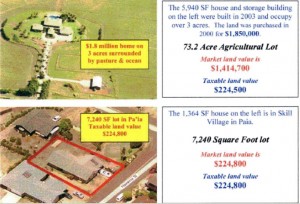

Council Member Mike White used the above example to illustrate his claim that small residential lots are often valued the same as much larger agricultural lots. Image prepared by Council Member Mike White. Click image to view in detail.

Committee members this week reviewed a request to address apparent disparities in real property assessments for agricultural lands on Maui.

Council Member Mike White filed the request with the Budget and Finance Committee on Tuesday saying, “The existing system results in regressive and unfair taxation.”

White submitted a 38-page document to the committee citing examples in which agricultural property owners are granted reductions in real property taxes, while much smaller lots are being taxed at essentially the same rate.

“These gentlemen estates and speculative purchases take advantage of existing real property tax rules and blur the lines between luxury living and the bona fide agricultural operations for which the rules were originally intended,” said White.

Rules established in 1981 encourage owners of land situated in the Agricultural District to put lands to agricultural use on a sustained basis and to discourage the conversion or subdivision of such lands for other uses.

“In many instances, these purposes are not being fulfilled and the exploitation of the rules have allowed the proliferation of large numbers of gentlemen estates and speculative land purchase to appear throughout the County.”

In one example, White compared a 73-acre oceanfront agricultural lot in Haiku to a 0.17-acre lot in Paia. Despite being 440 times larger, White said, the Haiku parcel had a taxable land value of $224,500–approximately $300 less than that of the Paia lot which had a taxable land value of $224,800.

“The families who own and reside in the small homes are essentially subsidizing the owners of the much larger estate properties,” said White.

This example, White says, illustrates the issue of subsidized land speculation. Image prepared by Council Member Mike White. Click image to view in detail.

White said another challenging tax issue is the matter of subsidized land speculation. He pointed to examples illustrating how a developer who purchased a large acreage of agricultural land, was able to retain the property’s agricultural assessment. Other properties, in comparison White said, are assessed at or close to market value.

An example shows a 149-acre parcel purchased in Pukalani for $4.75 million. Because of the property’s existing agricultural assessment, the taxable value of the property is $12,400, and the owner pays a mere $150 in property tax per yer.

White notes that existing laws allow the land to be held at the low tax rate, until such time the owner obtains a zoning change to allow for further development.

“This practice contradicts the intent of the agricultural assessment laws, which were designed to help sustain local agricultural operations, not subsidize speculation,” said White.

A third set of examples shows apparent disparities between agricultural lands and commercial properties, and uses the Monsanto property in Kihei to illustrate the point.

White notes that Monsanto paid $20 million in 2009 for a 310-acre agricultural parcel in Kihei. The company has a taxable value on the parcel of just $47,400, resulting in an annual tax payment of $275.

In comparison, commercial properties of valued at much less, pay much more according to White. According to the document submitted by White, the Maui Marketplace in Kahului has a land value of $18 million, and pays $299,123 annually in taxes; The Maui Mall in Kahului has a land value of $11.6 million, and pays $147,208 in taxes; and the Queen Kaahumanu Shopping Center has a land value of $15.2 million, and pays $689,018 in taxes.

“Even a small commercial lot in Waikapu pays more land tax than Monsanto’s 300-plus acres. All of Maui’s businesses pay exceptionally more land tax than the multi-billion dollar, international corporation pays for its Kihei land,” according to White’s presentation.

White said the questions raised are worthy of “immediate attention” and suggested the establishment of an investigative group to ensure fairness to taxpayers in fiscal year 2013 and beyond.