IRS Issued Second Batch of Economic Impact Payments to Taxpayers

The Internal Revenue Service announced today that the second batch of Economic Impact Payments stemming from the American Rescue Plan Act will be issued to taxpayers this week, with many payments arriving in the coming weeks in the form of paper check or prepaid debit card.

For taxpayers receiving direct deposit, this batch of $1,400 stimulus payments began processing Friday and will have an official pay date of March 24, although some payments may arrive sooner. Taxpayers who do not receive a direct deposit by March 24 should receive a paper check or prepaid debit card (known as an Economic Impact Payment Card or EIP Card) in the coming weeks.

No action is needed by most people to obtain this round of Economic Impact Payments. People can check the Get My Payment tool on IRS.gov to see if their payment has been scheduled.

“The IRS continues to send the third round of stimulus payments in record time,” IRS Commissioner Chuck Rettig said. “Since this new set of payments will include more mailed payments, we urge people to carefully watch their mail for a check or debit card in the coming weeks.”

Following enactment of the American Rescue Plan Act on March 11, the IRS initiated the first batch of the $1,400 stimulus payments, mostly by direct deposit, on March 12. The IRS and the Bureau of the Fiscal Service leveraged data in their systems to convert many payments to direct deposits that otherwise would have been sent as paper checks or debit cards. This accelerated the disbursement of these payments by weeks.

Taxpayers should note that the form of payment for the third EIP may be different from earlier stimulus payments. More people are receiving direct deposits, while those receiving them in the mail may get either a paper check or an EIP Card – which may be different than how they received their previous stimulus payments.

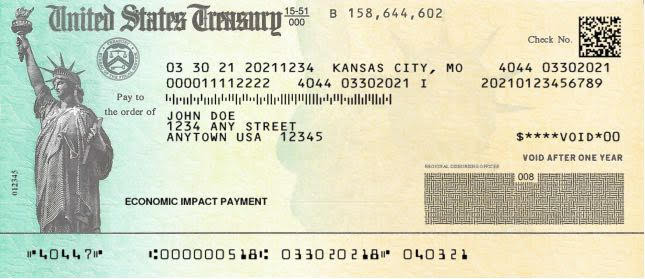

Paper checks will arrive by mail in an envelope from the U.S. Department of the Treasury. For those taxpayers who received their tax refund by mail, this paper check will look similar, but will be labeled as an “Economic Impact Payment.”

The EIP Card will come in a white envelope prominently displaying the seal of the U.S. Department of the Treasury. The card has the Visa name on the front and the issuing bank, MetaBank, N.A. on the back. Information included with the card will explain that this is an Economic Impact Payment. Each mailing will include instructions on how to securely activate and use the card. It is important to note that none of the EIP cards issued for any of the three rounds is reloadable; recipients will receive a separate card and will not be able to reload funds onto an existing card.

EIP Cards are safe, convenient and secure. EIP Card recipients can make purchases online or in stores anywhere Visa Debit Cards are accepted. They can get cash from domestic in-network ATMs, transfer funds to a personal bank account, and obtain a replacement EIP Card if needed without incurring any fees. They can also check their card balance online, through a mobile app or by phone without incurring fees. The EIP Card provides consumer protections against fraud, loss and other errors.

More information about these cards is available at EIPcard.com.