USDA Providing $67 Million in Loans for New Heirs’ Property Relending Program

The US Department of Agriculture is providing $67 million in competitive loans through the new Heirs’ Property Relending Program, which will help agricultural producers and landowners resolve heirs’ land ownership and succession issues.

Intermediary lenders — cooperatives, credit unions and nonprofit organizations – can apply for loans up to $5 million at 1% interest once the Farm Service Agency opens the two-month signup window in late August.

After the Farm Service Agency selects lenders, heirs can apply directly to those lenders for loans and assistance. Heirs’ property issues have long been a barrier for many producers and landowners to access USDA programs and services, and this relending program provides access to capital to help producers find a resolution to these issues.

Heirs’ property is a legal term that refers to family land inherited without a will or legal documentation of ownership. It has historically been challenging for heirs to benefit from USDA programs because of the belief that they cannot get a farm number without proof of ownership or control of land.

However, the Farm Service Agency provides alternative options that allow an heir to obtain a farm number. In states that have adopted the Uniform Partition of Heirs Property Act (UPHPA), producers may provide specific documents to receive a farm number. To learn more about heirs property, Heirsʻ Property Relending Program (HPRP) or UPHPA, go to farmers.gov/heirs/relending.

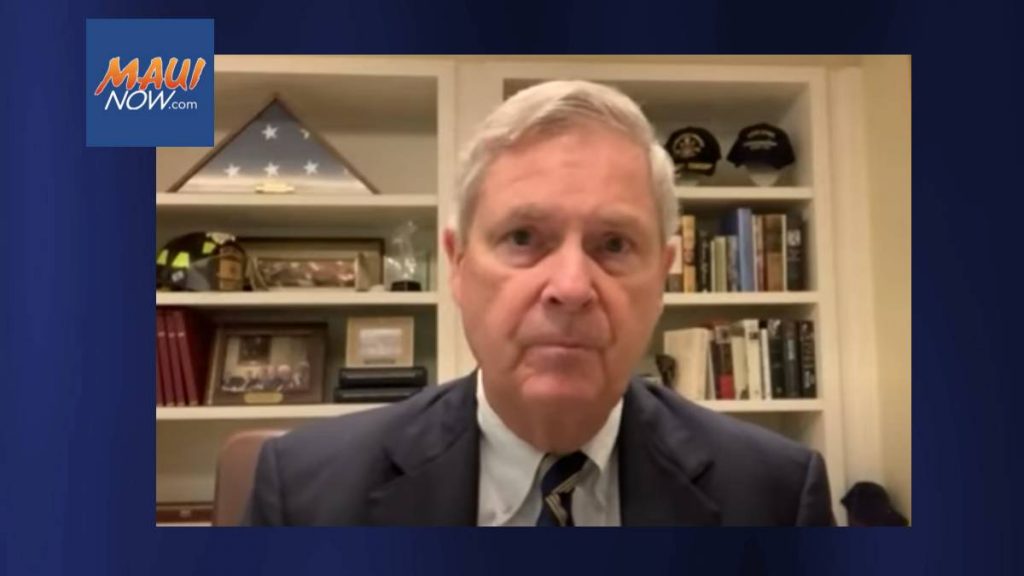

“While those affected are in all geographic and cultural areas, many Black farmers and other groups who have experienced historic discrimination have inherited heirs’ property,” Agriculture Secretary Tom Vilsack said in a news conference today. “USDA is committed to revising policies to be more equitable and examining barriers faced by heirs’ property owners is part of that effort. This helps ensure that we protect the legacy of these family farms for generations to come.”

The Heirs’ Property Relending Program is another example of how USDA is working to rebuild trust with America’s farmers and ranchers, according to a USDA news release.

HPRP is a loan and will need to be repaid as directed by the 2018 Farm Bill. The program’s benefits go far beyond its participants. It will also keep farmland in farming, protect family farm legacies and support economic viability.

Eligible Lenders:

To be eligible, intermediary lenders must be certified as a community development financial institution and have experience and capability in making and servicing agricultural and commercial loans that are similar in nature.

If applications exceed the amount of available funds, those applicants with at least 10 years or more of experience with socially disadvantaged farmers that are located in states that have adopted a statute consisting of enactment or adoption of the Uniform Partition of Heirs Property Act (UPHPA) will receive first preference.

A list of these states is available at farmers.gov/heirs/relending.

A secondary preference tier is established for those that have applications from ultimate recipients already in process, or that have a history of successfully relending previous HPRP funds. When multiple applicants are in the same tier, or there are no applicants in tier 1 or 2, applications will be funded in order of the date the application was received.

A webinar will be held Tuesday, Aug. 3, 2021 regarding applying for funding. Interested re-lender should register through the FSA Outreach and Education webpage.

Relending to Heirs:

Heirs may use the loans to resolve title issues by financing the purchase or consolidation of property interests and financing costs associated with a succession plan. This may also include costs and fees associated with buying out fractional interests of other heirs in jointly-owned property to clear the title, as well as closing costs, appraisals, title searches, surveys, preparing documents, mediation and legal services.

Heirs may not use loans for any land improvement, development purpose, acquisition or repair of buildings, acquisition of personal property, payment of operating costs, payment of finders’ fees or similar costs.

Intermediary lenders will make loans to heirs who:

- Are individuals or legal entities with authority to incur the debt and to resolve ownership and succession of a farm owned by multiple owners

- Are a family member or heir-at-law related by blood or marriage to the previous owner of the property

- Agree to complete a succession plan

More information on how heirs can borrow from lenders under HPRP will be available in the coming months.