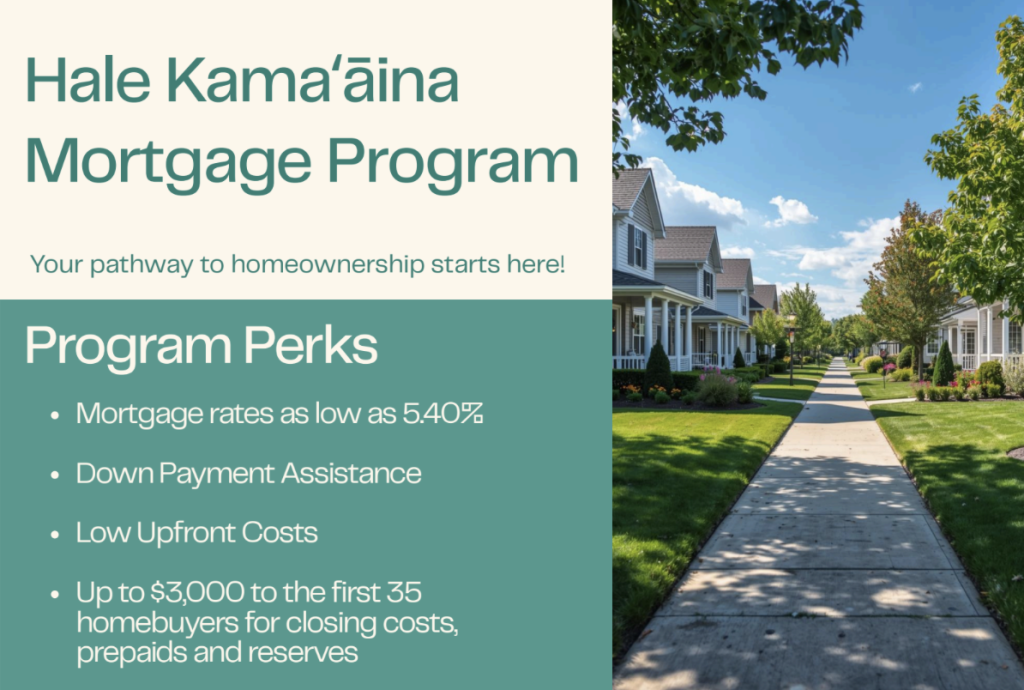

Hale Kamaʻāina Mortgage Program offers new incentives to further lower costs for first-time homebuyers

Mortgage Program. PC: Hawaiʻi Housing Finance and Development Corporation

Up to $3,000 more in funding is now available to each of the first 35 homebuyers in the Hale Kamaʻāina Mortgage Program, a state initiative aimed at offering first-time homebuyers below market rate mortgages.

Hale Kamaʻāina is a new program established by the Hawaiʻi Housing Finance and Development Corporation (HHFDC), aimed at those seeking to become homeowners by lowering their cost of entry.

Under new incentives approved by the HHFDC Board last week, the first 35 homebuyers who close their loans will receive up to $3,000 for closing costs, pre-paid expenses and reserves.

Hale Kamaʻāina’s biggest draw is that it offers first-time Hawai’i home purchasers 30-year, fixed-rate loans at significantly lower interest rates than market-rate loans. Mortgage rates could be as low as 5.40%, include down payment assistance and provide low upfront costs.

The program is financed through tax-exempt mortgage revenue bond proceeds.

HHFDC Executive Director Dean Minakami said the corporation recognizes the barriers faced by first-time homebuyers in Hawaiʻi. “We are pleased to offer this program to help kamaʻāina families purchase their first homes.”

Mortgage Program. PC: Hawaiʻi Housing Finance and Development Corporation

To be eligible for Hale Kamaʻāina, the hopeful homebuyer must be a US citizen or resident alien who lives in Hawaiʻi and must not have owned a primary residence in the past three years. Visit the HHFDC program website for a full list of eligibility requirements, participating lenders and other details about the program at https://dbedt.hawaii.gov/hhfdc/hk-mortgage-program/.

Interested first-time homebuyers should apply for first-mortgage loans through one of about a dozen participating lenders.

The mission of the Hawaiʻi Housing Finance and Development Corporation is to advance housing opportunities for the residents of Hawaiʻi.

_1768613517521.webp)