Real Property Tax rates surface for discussion in Maui Council on Friday

Proposed Real Property Tax Rates for the County of Maui will be discussed during a public hearing this Friday, May 13, at 11 a.m.

Budget, Finance and Economic Development Committee Chair Keani Rawlins-Fernandez made the announcement saying the proposal is reflective of an ongoing tax reform plan that began in 2019.

According to Rawlins-Fernandez, the effort received near full council support to adjust real property tax rates that benefit residents who live in their own homes, or rent long term to Maui residents, while increasing taxes for visitor accommodations, and for residents who own multiple homes. The proposal also included adjustments to tax classification ranges, considering inflated home valuations.

The plan strategically incorporates mitigative legislative steps that Rawlins-Fernandez said aims to “insulate and safeguard our residents from continuing to be priced out of their homes.” She said, “Driving local housing policy through taxation is complementary to the other prolific legislative solutions this council has been working on over the past several years.”

The long-term rental exemption and classification was passed in December of 2020, which Rawlins-Fernandez said can now be applied to insulate homeowners that rent long-term to residents.

“Without the long-term rental class, owners of multiple homes that do not rent long-term will fall into the non-owner-occupied class and be taxed at a higher rate to disincentive housing hoarding in Maui County or require equitable tax collection to offset the negative impacts resulting from extractive real estate investment activities,” according to a press release issued by the Molokaʻi council member.

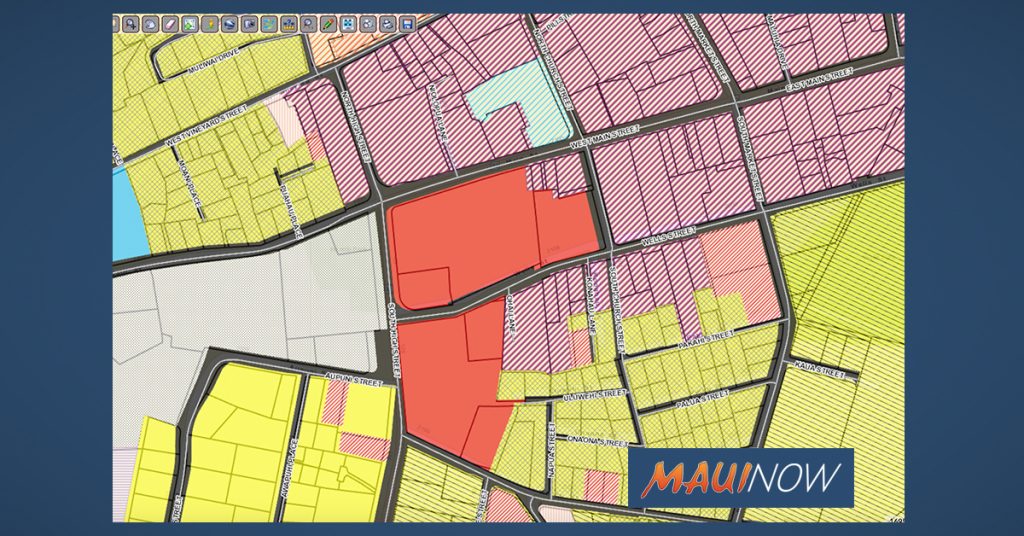

The real property tax rates per one thousand dollars of net taxable assessed valuation for each class of real property, effective July 1, 2022, are proposed as follows:

The council will accept public testimony via live video at https://bluejeans.com/295235670. Telephone testimony can be made by dialing 1-408-317-9253 and entering code 295 235 670.