Report: Single-family housing dominates Maui construction as market rebalances in 2025

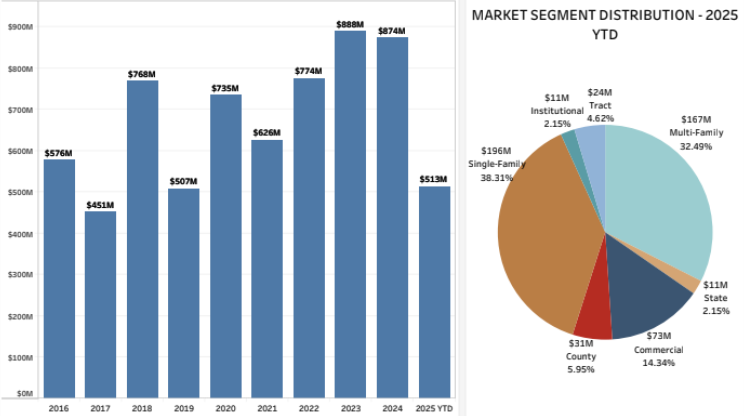

Maui County’s construction market is shifting sharply toward housing in 2025, with year-to-date activity reaching $513 million and single-family homes emerging as the island’s dominant construction driver, according to new data from Pacific Resource Partnership (PRP).

Single-family housing projects total $196 million so far this year and now make up 38% of Maui’s construction activity—a dramatic increase from 18% last year. PRP says the 20-percentage-point jump reflects an accelerated focus on residential development amid the island’s housing crisis and ongoing rebuilding needs following the 2023 wildfires.

The retreat from public-sector construction is even more dramatic. Public works account for just 8% of Maui’s 2025 construction market, down from 36% last year, mirroring a statewide shift toward private-sector investment.

Breakdown of Maui’s construction activity, Q3 YTD

According to the report:

- Single-family housing: $196 million (38.31%)

- Multi-family housing: $167 million (32.49%)

- Commercial projects: $73 million (14.34%)

- County projects: $31 million (5.95%)

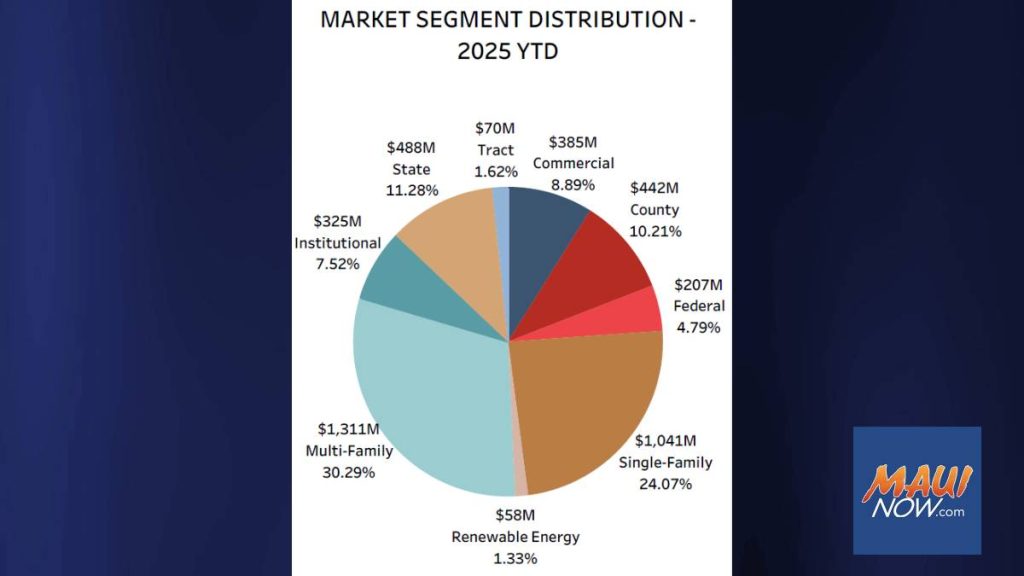

Hawai‘i’s construction industry reaches $4.33 billion in year-to-date spending

Across Hawai‘i, construction spending has reached $4.33 billion year-to-date, a sign the sector remains strong in 2025 despite broader economic uncertainty, according to PRP.

This year marks a major transition from the unusually high construction spending of 2022–2024, which was driven by several multibillion-dollar public projects:

• $2.6 billion for DOT asphalt resurfacing in 2022 (total spending that year: $8.03B)

• $3.4 billion for the Pearl Harbor Dry Docks project in 2023 (total spending: $9.47B)

• $1.6 billion for the HART City Center Guideway Stations in 2024 (total spending: $8.35B)

With those large public works projects now winding down, the market has shifted dramatically. The public sector, which made up 74% of total construction value in both 2022 and 2023, now represents just 26% of activity as of the third quarter of 2025.

PRP says the private sector now accounts for 74% of all construction statewide, a “fundamental re-balancing” of Hawai‘i’s construction priorities and a strong indicator of renewed investor confidence.

Breakdown of statewide construction activity

According to the report:

- Multi-family housing: $1.31 billion (30.29%)

- Single-family housing: $1.04 billion (24.07%)

- State-funded projects: $488 million (11.28%)

Hawai‘i Island remains an outlier in the multi-family boom, with only $17 million (2%) invested in such projects so far this year.

Meanwhile, county-funded initiatives total $442 million (10.21%) and emerging renewable energy efforts account for $58 million (1.33%), though PRP warns that the expiration of federal renewable subsidizes under the One Big Beautiful Bill Act could threaten the viability of projects still in the planning phase.

About the new report

The findings come from PRP’s inaugural Quarterly Hawai‘i Construction Market Update, a new report offering trends, insights and forecasts designed to inform industry leaders, policymakers and the public.

PRP’s in-house data analyst compiled information for the Quarterly Hawai‘i Construction Market Update through a comprehensive review of publicly available state, county and private market construction permits, minus HVAC and electrical permits.

“As Hawai‘i’s construction sector continues an unprecedented run, PRP is committed to keeping our community ahead of the curve,” said PRP Executive Director Nathaniel Kinney. “The Quarterly Hawai‘i Construction Market Update will spotlight opportunities and challenges ensuring Hawai‘i remains a beacon of innovation and growth.”

The full report and subscription sign-up are available at PRP-Hawaii.com.

Founded in 1987, Pacific Resource Partnership is a nonprofit organization that represents the Hawai‘i Regional Council of Carpenters, the largest construction union in the state with approximately 6,000 members, in addition to more than 250 diverse contractors ranging from mom-and-pop owned businesses to national companies.