Hawai‘i Journalism Initiative

Hawai‘i Journalism InitiativeFirst-time homebuyer program most popular among Maui fire survivors seeking aid from $1.6 billion federal grant

Kukui Keahi never dreamt of buying a home one day. She just knew she couldn’t afford it.

But when Maui County launched a program last week to give fire survivors like her up to $600,000 to buy a new home, it seemed for the first time that a home of her own could become a reality.

HJI Weekly Newsletter

Get more stories like these delivered straight to your inbox. Sign up for the Hawai‘i Journalism Initiative's weekly newsletter:

“I think it’s given people that hope that … ‘I can live at home. There’s a chance that I can stay here,’” said Keahi, who is the associate director of the Council for Native Hawaiian Advancement’s Kākoʻo Maui Relief & Aid Services Center but spoke individually about her experience as a renter.

Keahi ultimately decided not to apply, citing the costs of maintaining a home. But she is now handling the applications for hundreds of fire survivors eager to fulfill their own dreams.

On Monday, the county rolled out the first three Ho‘okumu Hou programs funded by a $1.6 billion federal grant to help fire survivors rebuild homes they lost in the Aug. 8, 2023 wildfires or afford to buy a home for the first time. Residents also can receive up to $1.2 million for reconstruction or up to $400,000 for reimbursement of already built homes.

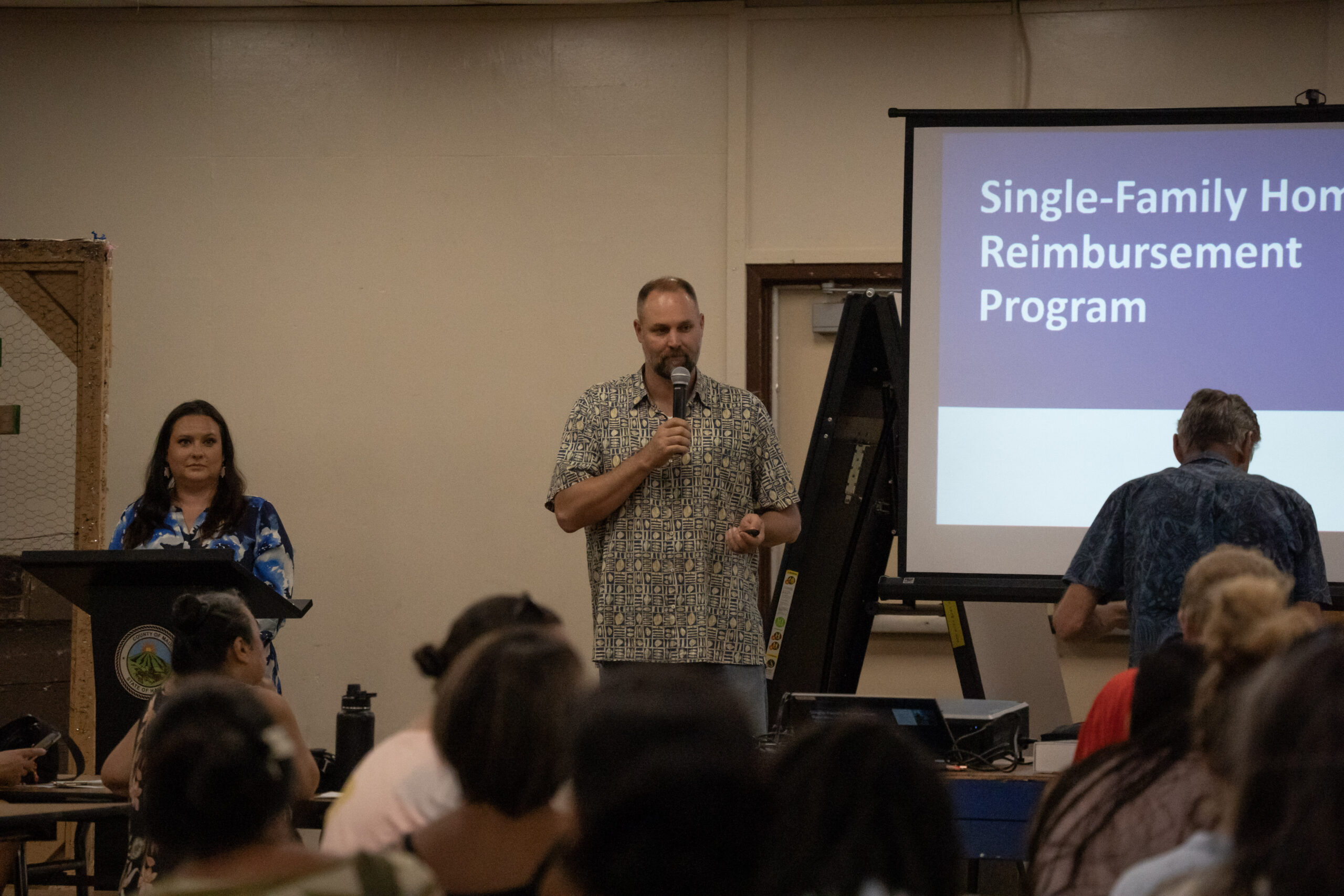

Just days after the launch, 446 people had applied: 355 for the first-time homebuyer program, 59 for single-family homeowner reconstruction and 32 for single-family homeowner reimbursement, the Maui County Office of Recovery reported on Wednesday at a meeting in Lahaina.

The surge in first-time homebuyer applications — which prioritize fire survivors but are also open to all first-time buyers under the income limits — reflect the impacts of the fire on renters as well as the island’s ongoing housing crisis at a time when the median price of a home is $1.3 million and a condo is $675,000.

Of the 4,000-plus households approved for assistance through the Federal Emergency Management Agency after the fire, 80% were renters. This percentage “is significantly higher than is typical of FEMA temporary housing options,” according to a 2024 study by the Argonne National Laboratory, which was asked by FEMA to look into its post-fire temporary housing programs and whether they’d caused property owners to increase rents or displace residents.

The report concluded that housing was already limited and renters were paying high rates before the fire destroyed an estimated 4,005 housing units. There wasn’t enough data to show that the temporary housing programs had impacted rental costs, though it “may have influenced the behavior of some property owners.”

In a University of Hawai‘i Economic Research Organization survey of nearly 1,000 people who lived and worked in Lahaina and Kula, about 45% of respondents said they were renting before the fire; as of July, that had jumped to about 60%.

More than 70% said they were paying less rent than before the fires, but more than 50% also said they had less income than before the fires. For about half of respondents, out-of-pocket expenses for their units were less because rental assistance covered all or nearly all of the cost.

Last year, Hawai‘i had the second-highest median gross rents in the country, and Maui had the highest median Craigslist asking rates at $2,550, according to UHERO’s Hawai‘i Housing Factbook released in May.

Nelson Salvador, director of organizing for the Hawai‘i Workers Center, which launched the Lahaina Filipino Fire Survivors Association in May, said “it has been two years of uncertainty” for survivors, and they’re “feeling the pressure of what will happen” after FEMA’s Direct Lease program support ends in February.

“Right now, the availability of rental units is very hard,” Salvador said. “They really want to be living in Lahaina because their jobs are in Lahaina, their children are studying in Lahaina.”

John Smith, administrator of the Office of Recovery, said the first-time homebuyers initiative “is really outside the box for what is typically done” with programs under U.S. Department of Housing and Urban Development, which provided the $1.6 billion in Community Development Block Grant-Disaster Recovery funds.

“We had such a high percentage of renters (in the burn zone), so that program is really geared toward helping folks become an owner,” Smith said Wednesday.

Of the $1.6 billion the county has received, $903.6 million is going towards housing, including $298.6 million for the reconstruction and reimbursement programs, $185 million for first-time homebuyers (half for new home construction and half for purchasing existing homes), $235 million for rebuilding multifamily rental housing and $185 million for new multifamily rental housing, according to the county’s action plan.

The multifamily rental programs will launch at a later date.

The Office of Recovery says it plans to take applications for the first three programs for six months, though that window could be extended depending on funding availability.

Income limits range from 50% to 140% of the area median income for the reconstruction and reimbursement programs and from 50% to 120% for the first-time homebuyer program. At 50% AMI, that means $47,150 for one person, $67,300 for a family of four and $88,850 for a family of eight. At 140%, that means $132,022 for one person, $188,440 for a family of four and $248,780 for a family of eight.

The funds are grants, meaning they don’t have to be paid back, but owners must agree to certain terms, including making the home their permanent residence or selling it at an affordable price in the future. Terms apply for 25 years if residents get the maximum of $1.2 million under the reconstruction program or 10 years if they get the maximum $400,000 under the reimbursement program.

First-time homebuyers have to buy a single-family home, townhouse or condo in Maui County that is not in a flood zone. The funding they can get is based on what they need to keep their housing costs at or below 30% of their total monthly income before taxes.

Like homeowners, they have to live in the home or sell it in the future at an affordable rate. The terms apply for 99 years. Applicants could also buy an empty lot and build a new home themselves, but they’d have to pay the cost upfront and get reimbursed when it’s finished.

With the application window and the requirements that include the county assigning a contractor for rebuilding, some residents at a July 30 meeting described it as “more hoops to jump through.”

Smith responded that “we’ll work to make it as small of a burden as we can, but we do … have to deal with the federal government and making sure that we complied with the regulations.”

For Keahi, who was a renter for more than a decade in Lahaina, the first-time homebuyers program piqued her interest because it was offering much more than similar programs that often provide just enough to cover a downpayment.

She thinks many displaced renters are eager to make sure they have a place to live versus having to wait for the rebuilding of the home or apartment complex they once rented.

“Some of them are in generational homes and grandma and grandpa can’t rebuild,” Keahi said. “So what else are they going to do? Make their own legacy.”

Born and raised in Lahaina to a family that goes back nine generations in the area, Keahi came home from college in 2012 and rented two different homes in Wahikuli before ending up in a three-bedroom, two-bathroom home on Lahainaluna Road in the summer of 2022. She worked two jobs at the Old Lāhainā Lu‘au and Anytime Fitness, and split the $4,500 rent with her sister and cousin.

She loved the home, “an old plantation house” that the owners kept adding on to.

“I threw birthday parties and Christmas parties with like 200 people in my backyard, and everyone still had room, and that’s rare in Lahaina,” Keahi said.

After the home burned down in the fire, she jumped between the homes of family and friends — “a couple months here, a couple months there, lived in my car for a little bit.” She felt like other people deserved the housing more than her, “so I wasn’t pushing it.”

Then, a FEMA agent she was working with said they’d find her a place. On Father’s Day weekend 2024, she moved into a Mā‘alaea condo and has been there ever since.

Applying for the homebuyers’ program “was a goal” when it first came out. Even with her agency handling the applications, Keahi could still apply, she just wouldn’t be allowed to process her own case.

But “then reality set in” as she thought about the overall costs and realized it would still take a good amount of her own savings to not only buy but also keep up a home.

“I would like to because I would like to leave something for my kids, but I don’t know,” she said.

She pointed out: “If I rent and the washer breaks, guess what? The landlord fixes it. If I’m the owner, I fix it. A brand-new washer is like $1,000. Who has that sitting in your back pocket?”

However, there are signs the market is relenting. While the price of a home in July was up 17% from the same time last year, condo prices have dropped 56%, due in part to uncertainty over the county’s proposal to ban short-term rentals in apartment districts. Bill 9 passed a Maui County Council committee in July and is headed for the full council for a vote in September.

Lahaina fire survivor Chamille Serrano is encouraging her daughter to apply for the first-time homebuyer program, and she’s hoping to qualify for one of the homeowner rebuilding programs.

The multigenerational family of eight — Serrano, her mom, her husband, their three daughters, one son-in-law and one 2-year-old grandson — once lived together in a 4,080-square-foot, six-bedroom home in Lahaina. Now, they’re currently divided between two units in Ka La‘i Ola, the state’s temporary housing project mauka of the town.

After losing their home, they lived with Serrano’s brother-in-law in Kahului, then the Hyatt Regency Maui and finally a home in Wailuku that they leased for a year until their insurance assistance ran out. Serrano put her 92-year-old mother in the care of her sister in Lahaina and lived with her husband in their aging Dodge Grand Caravan, going to her brother-in-law’s home to shower.

“For me and my husband, in the car, it doesn’t matter. Nothing fazes us anymore,” Serrano said.

They did that for two months until they landed a unit at Ka La‘i Ola in December. “It was a nice Christmas,” she said.

Serrano had hoped to spend the next Christmas in her rebuilt home, but it’s looking like less of a reality now. Her architect has just finished the blueprint and she hopes they can apply for a building permit by the end of this month. She has an appointment Wednesday to see if she’s eligible for one of the Ho‘okumu Hou programs. The family’s insurance payout went to cover their mortgage, and they received a $450,000 U.S. Small Business Administration loan, but it still leaves them short of the $715,000 cost to rebuild.

Under the homeowner rebuilding programs, survivors like Serrano can’t receive funds for things their insurance or previous loans have already paid for, but they could get funding to close the gap on what they need.

Even though Serrano has to start paying off her SBA loan in November, she’s not resentful toward folks who are getting Ho‘okumu Hou grants and won’t have debt. The timing worked out for them, and she’s happy to see it.

“All of us in Lahaina, as a community, I believe that we are going to be rising together, not having somebody left behind,” she said.

When asked how the county planned to help the most vulnerable fire survivors who don’t have the funds to start their recovery, Smith told the Hawai‘i Journalism Initiative last month that the Ho‘okumu Hou programs are “specifically designed” for those people.

But he pointed out that there are other programs in the budget for housing, social services and income gap support for those who don’t qualify for Ho‘okumu Hou.

For example, the Lahaina Community Land Trust is working to help fire survivors with insurance gaps and to buy land that could be kept in local ownership in perpetuity.

Smith said the county developed the plan to use the $1.6 billion based on community feedback, and that it would continue to listen to what survivors have to say. Last month, hundreds of people packed the Lahaina Civic Center social hall for a standing-room-only meeting on the Ho‘okumu Hou programs.

“We’re doing our best to pivot when we need to,” Smith said. “To meet the need of recovery where it is today and looking into the future,” Smith said.